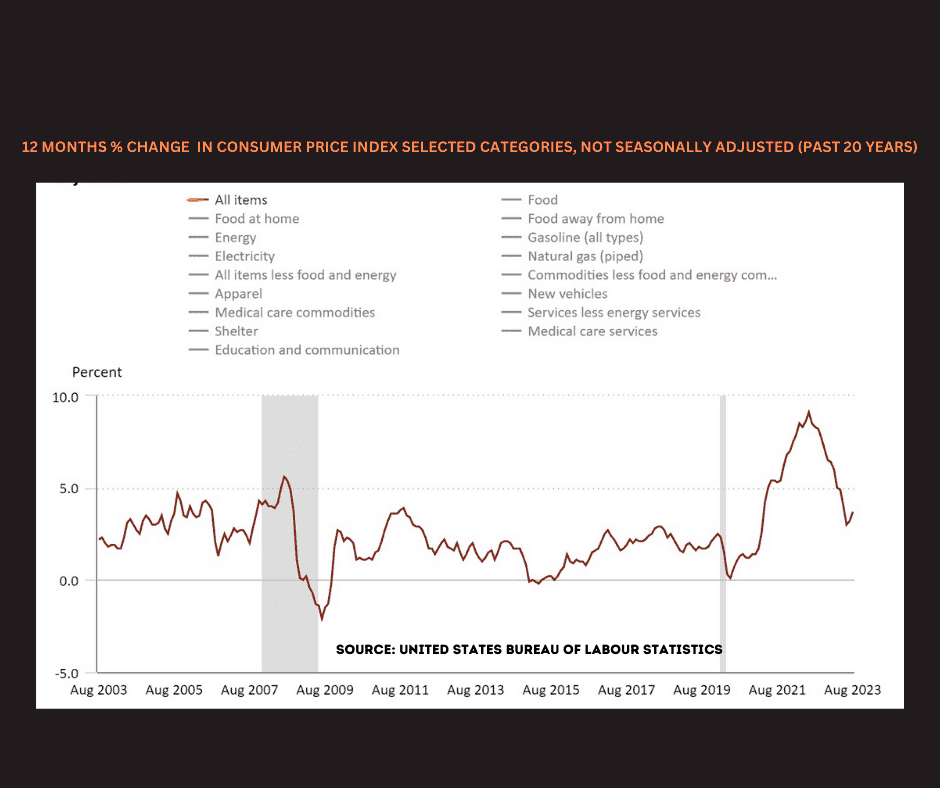

In August, the US consumer price Index experienced a slight increase due to a surge in oil prices, leading to a rise in overall inflation, as reported by the most recent data from the Bureau of Labor Statistics, United States, released on 13th September, 2023. The Consumer Price Index (CPI) saw a 0.6% increase compared to the previous month and a 3.7% increase compared to the previous year in August. This represented a faster pace of inflation compared to July, which saw a 0.2% monthly increase and a 3.2% annual price increase.

The year-over-year increase in prices was slightly higher than what economists had forecast, with expectations of a 3.6% annual increase, according to Bloomberg data. The main driver behind these price increases was a significant surge in energy prices. Oil prices reached new highs for the year, with West Texas Intermediate (CL=F) closing just below $89 per barrel, and Brent crude futures (BZ=F) exceeding $92 per barrel, marking the highest oil prices since November 2022.

When looking at core inflation, which excludes the more volatile costs of food and gas, prices in August increased by 4.3% compared to the previous year. This represented a slight slowdown from the 4.7% annual increase seen in July. Monthly core prices rose by 0.3%, slightly surpassing economist expectations of a 0.2% month-over-month gain, and also being higher than July’s 0.2% monthly rise.

The energy index saw a 3.6% decrease over the 12 months ending in August on an unadjusted basis, but prices increased by 5.6% on a seasonally adjusted month-over-month basis after a mere 0.1% increase in July. Gas prices, in particular, rose significantly by 10.6% in August, following a 0.2% increase in the previous month.

Within core inflation, rent prices continued to surge, with the index for rent and owners’ equivalents increasing by 0.5% and 0.4% on a monthly basis, respectively. Owners’ equivalent rent represents the hypothetical rent a homeowner would pay. The shelter index was the primary driver of the monthly increase in core inflation, with a 0.3% rise month-over-month and a 7.3% increase over the last year. However, these measures were slightly lower compared to July’s 7.7% annual gain and 0.4% monthly increase.

Other indexes that experienced increases in August included motor vehicle insurance, medical care, and personal care, as noted by the BLS. On the other hand, indexes for lodging away from home, recreation, and used cars and trucks saw decreases during the month. Used cars and trucks, in particular, saw their prices drop by another 1.2% in August after a 1.3% decrease in July.

The food index showed a 4.3% increase in August compared to the previous year, with food prices rising by 0.2% from July to August. Specifically, the index for food at home increased by 0.2% over the month after a 0.3% rise in July. The index for meats, poultry, fish, and eggs saw an increase of 0.8% in August, with the pork index rising by 2.2%. Additionally, the index for other foods at home increased by 0.2% over the month, and the index for cereals and bakery products rose by 0.5%, according to the BLS. However, egg prices continued to decline, dropping by 2.5% month-over-month after decreases of 2.2% in July and 7.3% in June. Headline inflation last month was significantly influenced by the huge increase in oil prices, which saw WTI crude oil reach its peak for 2023 in August and maintain this trend into September. While the core inflation rate has continued to decline and is now at its lowest point since mid-2021, the U.S. Federal Reserve is probably encouraged by this development.

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is a measure used to assess changes in the average prices paid by urban consumers for a basket of goods and services over time. It serves as a key indicator of inflation and is widely used by governments, economists, and policymakers to track and analyze changes in the cost of living. The CPI includes various categories of expenditure, such as housing, food, clothing, transportation, and healthcare, and it is used to gauge how price levels are impacting the purchasing power of consumers. Increases in the CPI indicate inflation, while decreases suggest deflation.

How is the Consumer Price Index Calculated?

The Consumer Price Index (CPI) is a comprehensive measure of inflation, changing consumer spending patterns across a wide range of products and services. Its computation is an intricate process that includes the following key steps:

1.Selecting the Basket of Goods and Services:

The first step in calculating the CPI is determining the basket of goods and services representing the average consumer’s spending habits. This basket includes various categories such as food, housing, clothing, transportation, healthcare, and entertainment.

2. Surveying Consumer Spending:

To create an accurate representation of consumer spending, data is collected through surveys. Households are asked to provide detailed information about their expenditures. This data is then used to determine each item’s relative importance (weight) in the basket.

3. Collecting Price Data:

Price data is collected regularly for thousands of items within the basket. Trained data collectors visit stores, markets, and service providers to record the prices of these items. Online prices are also considered to capture a comprehensive view of price changes.

4. Calculating Price Indexes:

For each item in the basket, a price index is calculated by dividing the current price by the base-year price (a reference year). This index measures the relative price change for that specific item over time.

5. Weighting Categories:

The weight of each category in the basket is determined by the percentage of consumer income spent on it. Categories with higher spending receive greater weight in the overall index.

6. Aggregating Price Indexes:

All the price indexes for individual items are combined into a single, weighted average using the category weights. This results in an overall price index for the entire basket of goods and services.

7. Establishing the Base Year:

The base year is a reference period against which all other years are compared. The CPI is set to 100 in the base year. Subsequent years’ CPI values are expressed as a percentage change from the base year.

8. Calculating the CPI:

To calculate the CPI for a specific year, the formula is as follows:

CPI = (Cost of Basket in Current Year / Cost of Basket in Base Year) x 100

9. Tracking Changes Over Time:

The CPI is calculated for each month and year, allowing for a continuous assessment of inflation trends. Comparing CPI values over time reveals how consumer prices have risen or fallen.

The CPI provides a valuable snapshot of how the cost of living changes over time, and it serves as a crucial tool for policymakers, economists, and individuals alike to monitor and respond to economic trends. Understanding this calculation process is key to interpreting

Consumer Price Index (CPI) as a Measure of Inflation

Let’s examine how the CPI measures inflation and the various aspects of inflation measurement:

Tracking Price Changes:

The CPI measures inflation by tracking changes in the average prices of the items within its basket of goods and services over time. It provides a snapshot of how the cost of living is evolving.

Base Year Comparison:

The CPI uses a base year as a reference point. The index is set to 100 in the base year, and subsequent CPI values are expressed as a percentage change from that base year. This allows for meaningful comparisons across time periods.

Calculating Inflation Rate:

The inflation rate is derived by comparing CPI values from two different periods. The formula for calculating the inflation rate is as follows:

Inflation Rate = ((CPI in Current Year – CPI in Previous Year) / CPI in Previous Year) x 100

Types of Inflation:

The CPI can be used to measure two main types of inflation:

Headline Inflation: This includes all items in the CPI basket, providing a comprehensive view of price changes across various categories.

Core Inflation: Core inflation excludes volatile items like food and energy from the CPI basket to focus on the underlying, more stable price trends.

Basket of Goods Adjustment:

The CPI’s basket of goods and services is periodically updated to reflect changes in consumer spending patterns. This ensures that the index remains relevant and accurately represents contemporary consumer behavior.

Regional and Demographic Variations:

Inflation can vary by region and demographic group. While the CPI provides a national average, specific regions or population segments may experience different inflation rates. Regional CPIs are sometimes calculated to address this variation.

Interpreting CPI Data:

Rising CPI values indicate inflation, suggesting that the cost of living is increasing. Conversely, falling CPI values suggest deflation, a decrease in the general price level. A stable CPI implies price stability.

CPI and Purchasing Power:

The CPI directly impacts individuals’ purchasing power. If the CPI outpaces wage growth, consumers may find it harder to afford the same standard of living. Conversely, a CPI that grows more slowly than income can enhance purchasing power.

Implications for Policy and Investments:

Governments and central banks closely monitor the CPI to make informed economic policy decisions. A rising CPI may prompt central banks to raise interest rates to combat inflation, while a falling CPI may lead to rate cuts to stimulate economic growth. Investors also use CPI data to make investment decisions.

Significance of CPI to Consumers

The Consumer Price Index (CPI) holds immense significance for individual consumers as it directly affects their purchasing power, financial planning, and overall quality of life. Here’s a closer look at why the CPI matters to consumers:

Cost of Living Assessment:

The CPI serves as a vital tool for consumers to evaluate changes in their cost of living. By tracking CPI trends, individuals can gauge how much more or less it costs to maintain their current standard of living.

Budgeting and Financial Planning:

Knowledge of CPI data is essential for effective budgeting and financial planning. When consumers understand how prices for various goods and services are changing, they can adjust their budgets accordingly to avoid financial strain.

Wage Negotiations and Employment Contracts:

Workers often use CPI data to negotiate salary raises or cost-of-living adjustments in their employment contracts. A CPI that outpaces wage growth can erode real income, making these negotiations critical.

Impact on Savings and Investments:

Inflation, as measured by the CPI, can erode the purchasing power of savings and investments. Consumers need to consider the CPI’s impact when making investment decisions, such as choosing assets that can outpace inflation.

Social Security and Government Benefits:

Many government programs, including Social Security, use CPI data to calculate benefit adjustments. Understanding CPI trends can help retirees and those on fixed incomes anticipate changes in their benefit payments.

Borrowing and Interest Rates:

Consumers who have loans with variable interest rates should be aware that changes in the CPI can influence interest rates. A rising CPI can lead to higher borrowing costs, affecting mortgages, credit cards, and other loans.

Informed Consumer Choices:

Consumers can make more informed choices about spending and consumption when they are aware of CPI data. For example, they may decide to substitute more affordable alternatives when prices for certain items in the CPI basket rise significantly.

Retirement Planning:

Individuals saving for retirement must consider the impact of inflation, as reflected in the CPI, on their retirement nest egg. Accurate retirement planning requires factoring in potential increases in the cost of living.

Asset Allocation:

Investors use CPI data to make informed decisions about asset allocation within their investment portfolios. Some assets, such as stocks or real estate, may offer better protection against inflation than others.

CPI and Government Policy

The Consumer Price Index (CPI) plays a pivotal role in shaping government policies and decisions, particularly in the realm of economic and fiscal policy.

Monetary Policy:

Central banks, such as the U.S. Federal Reserve, closely monitor the CPI to make decisions regarding monetary policy. When the CPI indicates rising inflation above the central bank’s target, it may respond by increasing interest rates to cool down the economy and stabilize prices. Conversely, a low CPI may lead to interest rate cuts to stimulate economic growth.

Fiscal Policy:

Government fiscal policies, including taxation and public spending, are influenced by the CPI. A high CPI can lead to adjustments in tax brackets and social benefits, potentially providing relief to those facing rising costs. Policymakers use CPI data to assess the impact of tax and spending policies on inflation and household budgets.

Social Security and Government Benefits:

Many government programs tie benefit adjustments to the CPI. For example, Social Security benefits in the United States are subject to cost-of-living adjustments (COLAs) based on changes in the CPI. A rising CPI can lead to larger benefit increases for retirees and other beneficiaries.

Inflation Targeting:

Some countries adopt inflation targeting as part of their monetary policy framework. In this approach, the central bank sets a specific inflation target, often based on the CPI. Policymakers aim to keep inflation within a target range to promote price stability and economic growth.

Public Debt Management:

Government bonds and securities are affected by changes in inflation, as measured by the CPI. A high CPI may lead to higher yields on government bonds, making it more costly for governments to service their debt. Bond investors also consider CPI trends when assessing the purchasing power of future interest and principal payments.

Economic Planning and Forecasting:

Governments use CPI data for economic planning and forecasting. It helps policymakers assess how changes in prices will impact various sectors of the economy and inform decisions on trade, investment, and industrial policies.

Wage and Labor Policies:

Governments often use CPI data as a reference point when setting minimum wages or regulating labor contracts. Labor unions and employers may also negotiate wage adjustments based on CPI trends to ensure that workers’ salaries keep pace with rising living costs.

Public Opinion and Trust:

Public perception of government economic management is influenced by changes in the cost of living. High and unpredictable inflation can erode public trust in government, making the CPI an important barometer of public sentiment.

Economic Stimulus and Austerity Measures:

During periods of economic downturn, governments may use CPI data to determine the need for stimulus or austerity measures. A low CPI may indicate the need for economic stimulus to combat deflation, while a high CPI may lead to austerity measures to control inflation.

Limitations of Consumer Price Index (CPI)

While the Consumer Price Index (CPI) is a widely used and valuable economic indicator, it is not without its criticisms and limitations. It’s important to understand these shortcomings to interpret CPI data accurately and to consider alternative measures when necessary.

Substitution Bias:

The CPI assumes that consumers do not change their spending patterns in response to price changes. In reality, consumers often substitute cheaper alternatives for goods and services when prices rise. This can cause inflation to be overestimated.

Quality Bias:

The CPI might not accurately reflect changes in product quality over time. If the quality of a product increases (e.g., smartphones with more features), the CPI may not capture the true value consumers receive for their money, resulting in an overestimation of inflation.

New Product Bias:

The CPI may not account for new products entering the market. Innovative products or services that offer better value may not be adequately represented in the basket of goods and services, leading to an understatement of consumer welfare.

Geometric Mean Formula:

The CPI uses a geometric mean formula to aggregate price changes across items in the basket. This formula assumes that consumers can optimize their purchasing by minimizing costs, which may not reflect real-world consumer behavior accurately.

Regional and Demographic Variations:

The CPI provides a national average, which may not reflect the inflation experienced by specific regions or demographic groups. In some areas, housing costs or healthcare expenses may rise more rapidly than the national average.

Changes in Consumer Behavior:

Events like the COVID-19 pandemic can significantly alter consumer spending habits. The CPI may not immediately capture these shifts in behavior, leading to inaccuracies during extraordinary times.

Lack of Housing Market Accuracy:

The CPI’s treatment of housing costs, particularly through owner-occupied housing, has been criticized. It may not accurately reflect fluctuations in home prices and the true cost of housing for homeowners.

Exclusion of Asset Prices:

The CPI does not consider changes in asset prices, such as real estate or stock prices. Asset price bubbles can have significant economic consequences, but they are not directly incorporated into CPI calculations.

Weighting and Basket Updates:

The CPI’s basket of goods and their weights are updated periodically, but these updates may not keep pace with changing consumer spending patterns, leading to potential inaccuracies.

Perception of Inflation:

The CPI may not capture the way individuals subjectively experience inflation. Some consumers may be more affected by price changes in specific items not well-represented in the CPI basket.

Seasonal Variations:

Seasonal fluctuations in prices, such as holiday sales or back-to-school discounts, can impact the accuracy of CPI measurements if not accounted for correctly.