Introduction

The credit card industry, serving as a linchpin within modern financial ecosystems, extends beyond mere transaction facilitation to mirror the economic rhythms of nations. This article embarks on a comprehensive journey, unraveling the historical trajectory, current dynamics, and the influential role played by India in shaping the global credit card narrative.

Global Credit Card Industry- Market Size & Growth

MORDOR INTELLIGENCE

Cumulatively, this surge in credit card debt amounts to a staggering USD 38 billion within a single quarter, signifying a notable 15% year-over-year escalation—representing the most substantial change witnessed in the last two decades. The data underscores a pivotal shift in financial behavior, prompting scrutiny. Notably, the proportion of transactions conducted through credit cards is markedly higher among households with elevated incomes. Specifically, it escalates to 34% for households earning between USD 100,000 and USD 149,999 and further jumps to 44% for those with incomes exceeding USD 150,000. This trend underscores the correlation between income levels and the preference for credit card transactions.

ALLIED MARKET RESEARCH

In 2022, the worldwide credit card payments market held a valuation of $524.9 billion. Projections indicate a substantial growth trajectory, with an anticipated reach of $1.2 trillion by the year 2032. This growth is forecasted to occur at a Compound Annual Growth Rate (CAGR) of 8.8% from the year 2023 through 2032.

The surge in the desire for alternatives to cash and the widespread availability of cost-effective credit cards on a global scale contribute to the expansion of the worldwide credit card payments market. Furthermore, the increasing demand for credit cards in developing nations serves as a positive catalyst for market growth. Nevertheless, the anticipated rise in global credit card fraud poses a challenge to the market’s progression. Conversely, the advent of technological enhancements in product features, such as leveraging blockchain for heightened security, is anticipated to present lucrative opportunities for market expansion throughout the forecast period.

The segmentation of the credit card payments market is organized according to product type, application, brand, and geographical region. Regarding product type, the market is divided into general-purpose credit cards, as well as specialty and other credit cards. In terms of application, the market exhibits fragmentation across various sectors, including food and groceries, health and pharmacy, restaurants and bars, consumer electronics, media and entertainment, and travel and tourism, among others. The market is further categorized by brand, with distinctions made between Visa, Mastercard, and other brands. Geographically, the market is assessed in North America, Europe, Asia-Pacific, and LAMEA.

Credit Card Penetration

Credit card penetration refers to the percentage of a population or a specific market that possesses and actively uses credit cards. It is a metric that reflects how credit cards are adopted and utilized within a given demographic or geographic area. This measurement is often expressed as a percentage and is calculated by dividing the number of active credit cardholders by the total population or the target market.

A high credit card penetration rate indicates widespread acceptance and usage of credit cards within a population. Conversely, a low penetration rate suggests that a smaller proportion of the population uses credit cards as a financial tool.

Factors influencing credit card penetration include economic conditions, financial literacy, cultural preferences, regulatory environment, and the availability of banking services. Developed economies typically have higher credit card penetration rates compared to developing economies, where alternative forms of payment may be more prevalent.

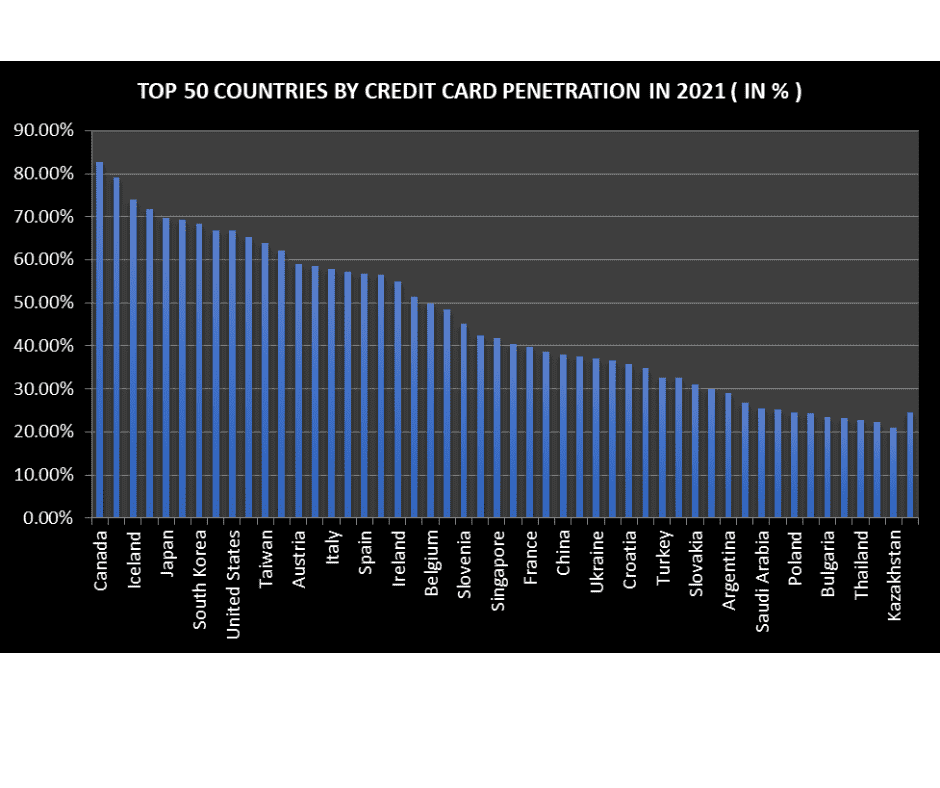

| COUNTRIES | TOP 50 COUNTRIES BY CREDIT CARD PENETRATION (IN %) | |||

| 2011 | 2014 | 2017 | 2021 | |

| Canada | 72.33% | 77.07% | 82.58% | 82.74% |

| Israel | 79.66% | 76.16% | 75.02% | 79.05% |

| Iceland | 0% | 0% | 0% | 74% |

| Hong kong | 58.08% | 64.26% | 65.42% | 71.63% |

| Japan | 64.44% | 66.08% | 68.38% | 69.66% |

| Switzerland | 0% | 54% | 65.47% | 69.21% |

| South Korea | 56.43% | 56.02% | 63.66% | 68.44% |

| Norway | 0% | 67.21% | 70.5% | 66.74% |

| United States | 61.94% | 60.13% | 65.6% | 66.7% |

| Finland | 63.87% | 63.07% | 62.78% | 65.29% |

| Taiwan | 45.86% | 54.88% | 53.46% | 63.77% |

| United Kingdom | 51.56% | 61.69% | 65.37% | 62.11% |

| Austria | 38.92% | 40.17% | 46.55% | 58.99% |

| Denmark | 44.92% | 36.48% | 44.72% | 58.5% |

| Italy | 30.5% | 36.22% | 42.48% | 57.88% |

| New Zealand | 59.2% | 61.41% | 60.87% | 57.21% |

| Spain | 41.88% | 54.38% | 53.88% | 56.61% |

| Germany | 35.71% | 45.81% | 52.54% | 56.52% |

| Ireland | 55.65% | 45.98% | 50.86% | 54.96% |

| Australia | 64.23% | 58.56% | 59.69% | 51.41% |

| Belgium | 54.33% | 43.03% | 48.42% | 49.82% |

| Sweden | 53.53% | 45.36% | 44.98% | 48.35% |

| Slovenia | 38.6% | 35.18% | 42.17% | 45.05% |

| Malta | 52.91% | 41.83% | 47.11% | 42.48% |

| Singapore | 37.35% | 35.42% | 48.9% | 41.74% |

| Brazil | 29.24% | 32.05% | 27.03% | 40.43% |

| France | 37.52% | 44.14% | 40.93% | 39.76% |

| Portugal | 29.64% | 28.54% | 33.59% | 38.54% |

| China | 8.23% | 15.83% | 19.49% | 37.95% |

| Netherlands | 41.39% | 33.63% | 39.1% | 37.43% |

| Ukraine | 19.33% | 27.5% | 26.68% | 37.02% |

| Uruguay | 27.11% | 39.81% | 40.59% | 36.55% |

| Croatia | 34.76% | 37.99% | 35.47% | 35.75% |

| Estonia | 30.22% | 31.34% | 29.35% | 34.86% |

| Turkey | 45.08% | 32.82% | 41.6% | 32.61% |

| Cyprus | 45.87% | 26.33% | 22.94% | 32.48% |

| Slovakia | 20.32% | 17.03% | 22.14% | 30.94% |

| Czechia | 26.45% | 25.7% | 25% | 29.85% |

| Argentina | 21.94% | 26.58% | 23.97% | 28.89% |

| United Arab Emirates | 29.98% | 37.42% | 45.44% | 26.84% |

| Saudi Arabia | 16.91% | 11.53% | 16.27% | 25.42% |

| Russia | 9.68% | 21% | 20.08% | 25.08% |

| Poland | 17.69% | 16.75% | 16.52% | 24.44% |

| Chile | 22.85% | 28.09% | 29.85% | 24.28% |

| Bulgaria | 10.43% | 12.2% | 13.55% | 23.27% |

| Greece | 17.46% | 11.57% | 11.97% | 23.17% |

| Thailand | 4.51% | 5.69% | 9.8% | 22.61% |

| North Macedonia | 16.55% | 21.2% | 17.38% | 22.2% |

| Kazakhstan | 8.59% | 11.48% | 19.97% | 20.86% |

| World | 14.94% | 17.47% | 18.13% | 24.48% |

| Source: Statista | ||||

The data reveals a significant global increase in credit card penetration rates, progressing from 14.94% in 2011 to 24.48% in 2021. This indicates a substantial shift towards credit card usage on an international scale.

Noteworthy leaders in credit card penetration rates in 2021 include Canada (82.74%), Israel (79.05%), and Iceland (74%). These countries consistently maintain elevated penetration rates, reflecting a robust credit card culture and widespread adoption.

Countries with established economies, such as Hong Kong, Japan, Switzerland, the United States, and Australia, exhibit steady growth in credit card penetration. Despite minor fluctuations, these nations maintain relatively high and stable penetration rates.

European nations like the United Kingdom, Austria, Denmark, Italy, Spain, Germany, Ireland, Belgium, Sweden, Slovenia, Malta, and France display diverse patterns, featuring fluctuations and gradual increases in credit card penetration. This diversity highlights the nuanced financial landscapes within Europe.

Asian and Middle Eastern countries, including Taiwan, Singapore, China, Japan, the United Arab Emirates, Saudi Arabia, Russia, and Thailand, showcase varied trends. While some demonstrate consistent growth, others experience fluctuations, underscoring the diverse financial ecosystems in these regions.

Emerging markets such as Brazil, Ukraine, Uruguay, Croatia, Estonia, Turkey, Cyprus, Slovakia, Czechia, Argentina, and Poland demonstrate evolving credit card penetration rates. Several of these nations experience substantial growth, signaling a shift towards increased credit card adoption.

Certain countries, including Chile, Bulgaria, Greece, North Macedonia, Kazakhstan, and the global aggregate World, show moderate increases, indicating challenges or variations in credit card adoption. Additionally, Brazil, Portugal, the United Arab Emirates, Saudi Arabia, and Russia have experienced declines in credit card penetration, suggesting potential shifts in payment preferences or economic factors.

Credit Card Industry in India

The credit card sector in India has experienced remarkable growth, marked by numerous advancements, innovations, and technological transformations. These progressions have introduced seamless onboarding processes, distinctive card offerings, personalized incentives, and improved mobile applications. Such innovations have proven highly advantageous for existing customers and are effective in attracting new clientele. Credit card issuers are actively seeking to introduce additional innovations and enhance awareness within this domain, contributing significantly to the substantial expansion observed in India’s credit card market.

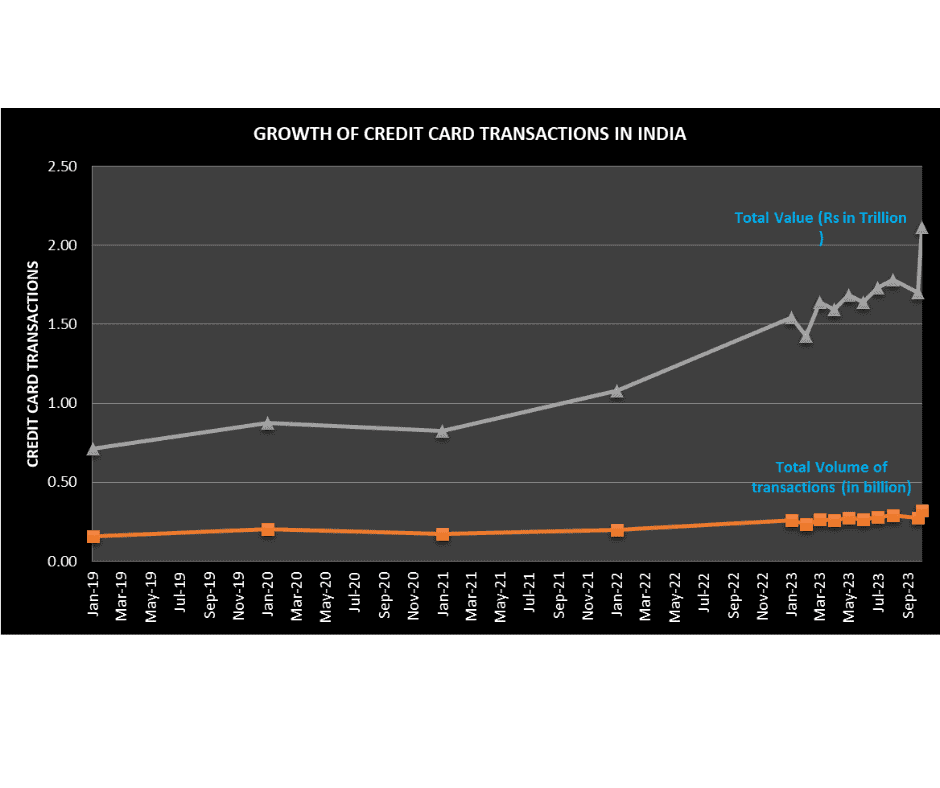

| MONTH | CREDIT CARD TRANSACTIONS IN INDIA | |

| TOTAL VOLUME OF TRANSACTIONS (IN BILLION) | TOTAL VALUE OF TRANSACTIONS (RS IN TRILLION) | |

| October-2023 | 0.32 | 1.79 |

| September-2023 | 0.27 | 1.43 |

| August-2023 | 0.29 | 1.49 |

| July-2023 | 0.28 | 1.45 |

| June-2023 | 0.26 | 1.38 |

| May-2023 | 0.27 | 1.41 |

| April-2023 | 0.26 | 1.33 |

| March-2023 | 0.26 | 1.38 |

| February-2023 | 0.23 | 1.19 |

| January-2023 | 0.26 | 1.28 |

| January2022 | 0.20 | 0.88 |

| January-2021 | 0.17 | 0.65 |

| January-2020 | 0.20 | 0.67 |

| January-2019 | 0.16 | 0.55 |

| Source: RBI | ||

The data illustrates a continuous upward trend in the volume of credit card transactions, reaching a significant milestone of 0.32 billion transactions in October 2023. Despite occasional fluctuations, the overall trajectory indicates a growing dependence on credit cards for financial transactions. Corresponding to the volume trend, the total value of credit card transactions in rupees has experienced a positive surge, reaching 1.79 trillion in October 2023. This increase in transaction values aligns seamlessly with the broader trend of escalating credit card usage across the country.

The monthly analysis highlights October 2023 as the zenith for both transaction volume and value, emphasizing potential factors such as economic activities, festive seasons, or promotional campaigns that contribute to these peaks. A year-over-year comparison between January 2023 and January 2022 underscores substantial growth in both transaction volume and value, confirming the growing prominence of credit cards in the financial landscape. The extended analysis from January 2019 to October 2023 further reinforces the positive trajectory, signifying the maturation of the credit card market in India.

This consistent growth corresponds with evolving consumer preferences, heightened digitalization, and the burgeoning middle class, all contributing to the surge in credit card transactions. Peaks in transaction volume and value suggest a correlation with economic indicators, festive seasons, and promotional activities.

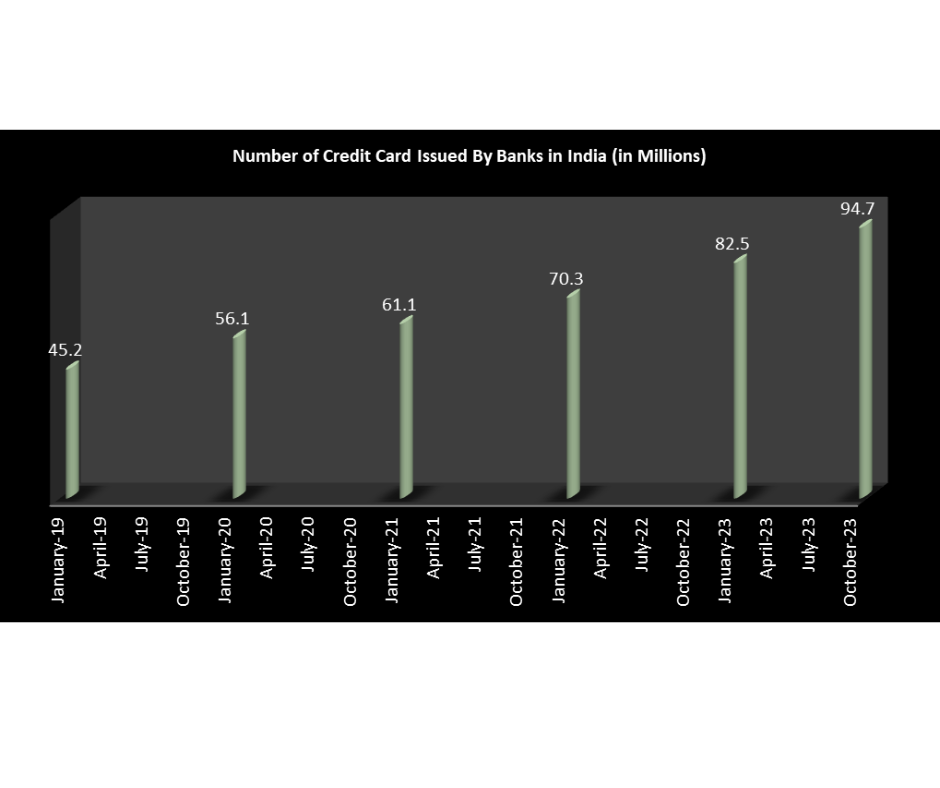

| NUMER OF CREDIT CARDS ISSUED BY BANKS IN INDIA | |

| MONTH | NUMBER OF CREDIT CARDS ISSUED (IN MILLIONS) |

| October-2023 | 94.7 |

| September-2023 | 93.0 |

| August-2023 | 91.3 |

| July-2023 | 89.9 |

| June-2023 | 88.7 |

| May-2023 | 87.7 |

| April-2023 | 86.5 |

| March-2023 | 85.3 |

| February-2023 | 83.4 |

| January-2023 | 82.5 |

| January-2022 | 70.3 |

| January-2021 | 61.1 |

| January-2020 | 56.1 |

| January-2019 | 45.2 |

| Source: RBI | |

There has been a steady upward trajectory in the issuance of credit cards by Indian banks over the last four years, reaching a culmination of 94.7 million cards in October 2023. This growth signals a robust and enduring expansion within the credit card market. Throughout the period from January 2019 to October 2023, a noticeable trend emerges, characterized by monthly increases in credit card issuance. This incremental rise underscores a consistent demand for credit cards among consumers.

The comparison between January 2019 and October 2023 reveals a remarkable surge in the number of issued credit cards, indicating a substantial increase of nearly 49.5 million cards.

In the most recent months, spanning from January 2023 to October 2023, there has been a notable acceleration in growth, with the number of credit cards escalating from 82.5 million to 94.7 million. This period reflects dynamic market forces and potentially heightened consumer interest in adopting credit cards.

The expansion in credit card issuance appears to be influenced by various economic factors, including heightened consumer confidence, favorable interest rates, and the growth of the digital economy. Additionally, promotional campaigns and strategic partnerships by banks are likely contributors to this growth.

Year-over-year comparisons underscore significant growth, particularly evident when examining October 2023 against October 2022, revealing an increase of over 24.4 million credit cards.

The consistent growth in credit card issuance aligns harmoniously with positive industry indicators, suggesting an upward trend in consumer reliance on credit instruments for financial transactions.

The sustained growth in credit card issuance implies an enduring demand for financial products in the credit card segment. Banks may consider capitalizing on this trend by introducing innovative features, enticing rewards, and customized services to cater to the evolving preferences of consumers.

Credit Card Market Share in India

The credit card market in India has experienced substantial growth, marked by swift technological progress. Prominent advancements, such as streamlined onboarding procedures, distinctive card offerings, personalized incentives, and improved mobile applications, have provided advantages for current users and enticed new ones. Credit card issuers are actively engaged in heightening awareness and promoting innovation within this market, and the evident expansion of India’s credit card market serves as a testament to these initiatives.

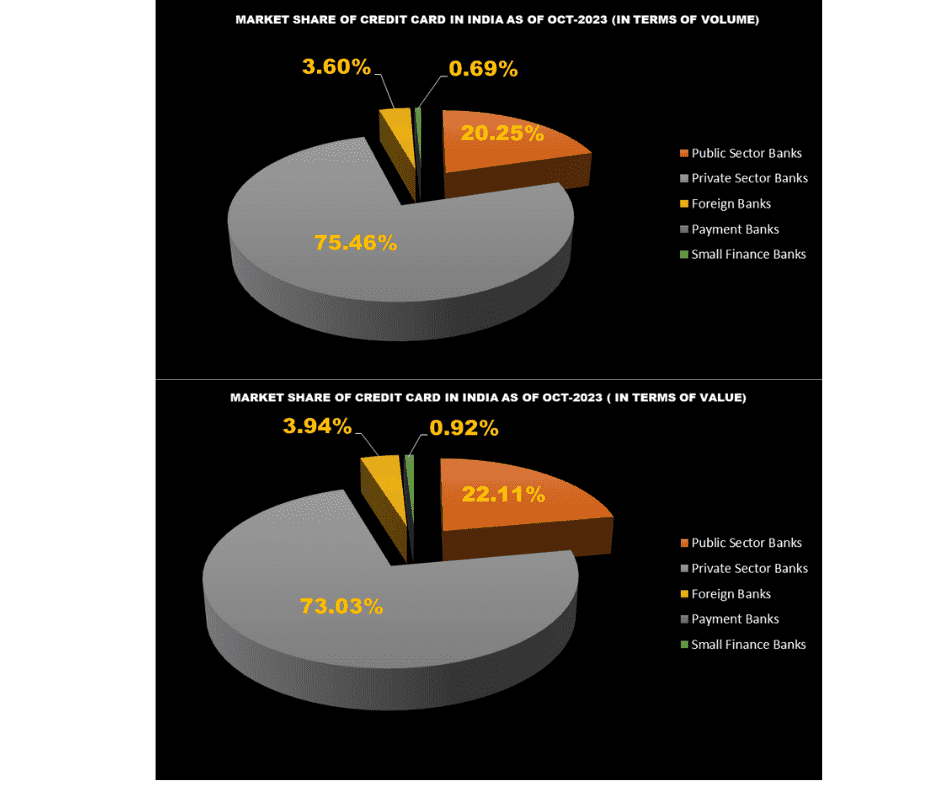

| CREDIT CARD MARKET SHARE IN INDIA AS OF OCT-2023 | ||

| BANK BY SECTOR | MARKET SHARE (IN VOLUME OF TRANSACTIONS) | MARKET SHARE (IN VALUE OF TRANSACTIONS) |

| Public Sector Bank | 20.25% | 22.11% |

| Private Sector Bank | 75.46% | 73.03% |

| Foreign Banks | 3.60% | 3.95% |

| Payments Bank | 0% | 0% |

| Small Finance Bank | 0.69% | 0.92% |

| Source: RBI | ||

Private Sector Banks hold a commanding presence in the credit card market, securing an impressive 75.46% share in terms of volume. In comparison, Public Sector Banks follow closely with a substantial 20.25% share, highlighting their significant footprint. Foreign Banks contribute a 3.60% share, adding to the market’s diversity.

In the realm of credit card transaction values, Private Sector Banks continue their dominance, accounting for a noteworthy 73.03%. Public Sector Banks closely trail with a significant 22.11% share, emphasizing their influence on transactions of higher value. Foreign Banks maintain a proportionate representation, holding a 3.95% share in value.

The remarkable dominance of Private Sector Banks in both volume and value underscores their robust position within the credit card market. This can be attributed to strategic offerings, extensive customer reach, and innovative product features. Public Sector Banks, while holding a smaller share than their private counterparts, exhibit resilience by capturing a significant portion of both volume and value. This indicates a substantial customer base relying on credit cards issued by Public Sector Banks.

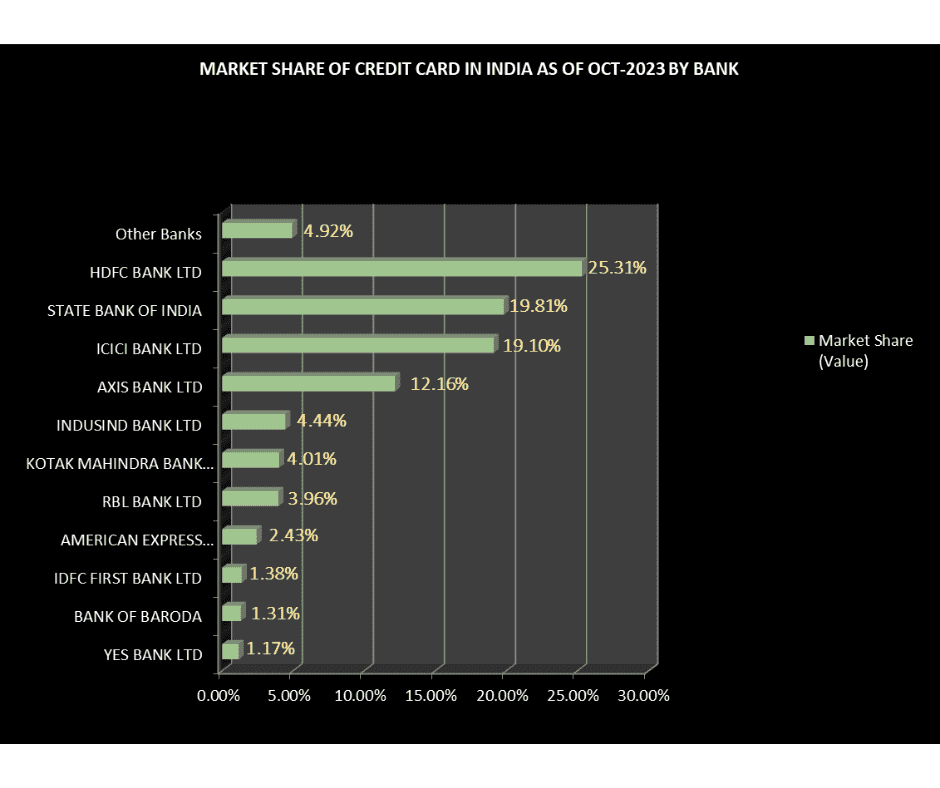

| MARKET SHARE OF CREDIT CARD IN INDIA AS OF OCT-2023 BY BANK | |

| BANK | MARKET SHARE (VALUE OF TRANSACTIONS) |

| HDFC BANK LIMITED | 25.31% |

| STATE BANK OF INDIA | 19.81% |

| ICICI BANK LIMITED | 19.10% |

| AXIS BANK LIMITED | 12.16% |

| INDUSIND BANK LIMITED | 4.44% |

| KOTAK MAHINDRA BANK | 4.01% |

| RBL BANK LIMITED | 3.96% |

| AMERICAN EXPRESS BANKING CORPORATION | 2.43% |

| IDFC FIRST BANK LIMITED | 1.38% |

| BANK OF BARODA | 1.31% |

| YES BANK | 1.17% |

| OTHER BANKS | 4.92% |

| Source: RBI | |

As of October 2023, the credit card market in India exhibits a distinct hierarchy in terms of market share by value of transactions. HDFC Bank Limited leads with a substantial 25.31% share, emphasizing its significant influence on the value of credit card transactions, underscoring its prominence. Following closely, SBI, a public sector giant, commands a noteworthy market share of 19.81%, solidifying its position as a major player in the credit card market. The bank’s extensive customer base contributes significantly to its transaction value.

ICICI Bank secures a robust market share of 19.10%, showcasing its competitive standing in the credit card market. Its strategic offerings and customer-focused approach contribute to its substantial transaction value.

Axis Bank holds a considerable market share of 12.16%, positioning itself as a key player in credit card transactions. The bank’s diverse product portfolio and customer-centric services contribute to its share.

IndusInd Bank Limited and Kotak Mahindra Bank follow with shares of 4.44% and 4.01%, respectively, contributing to the diversity of the market. These two banks’ specialized services and tailored offerings contribute to their share of transaction values.

Smaller players such as RBL Bank Limited, American Express Banking Corporation, IDFC First Bank Limited, Bank of Baroda, and Yes Bank each carve out their niche with shares ranging from 3.96% to 1.17%. The collective contribution of other banks stands at 4.92%, highlighting the presence of various players in the credit card market.

Evolutionary Shifts in the Indian Credit Card Market

The evolution of the credit card market in India is a fascinating journey that mirrors the dynamic shifts in the country’s economic landscape and consumer behavior. Over the years, credit cards have transformed from a luxury for the elite to a ubiquitous financial tool embraced by a growing middle class. This evolution has been marked by several key phases, each contributing to the widespread adoption and evolution of credit cards in India.

Emergence and Elite Adoption (1980s – 1990s):

The credit card journey in India commenced in the 1980s with the introduction of cards by international players. Initially, credit cards were considered a status symbol and were predominantly accessible to the affluent. The concept of revolving credit and cashless transactions was a novelty, and the market was nascent.

Liberalization and Mass Market Entry (1990s – 2000s):

The economic liberalization of the 1990s opened new horizons for the credit card market. Domestic banks entered the scene, and the market witnessed a shift from being elite-centric to a broader consumer base. Banks started offering credit cards with diverse features, catering to the evolving needs of consumers. The concepts of creditworthiness and financial inclusion gained prominence.

Technology Integration and Online Transactions (2000s – 2010s):

The 21st century brought a technological revolution that significantly impacted the credit card landscape. Online transactions became prevalent, and banks leveraged technology to provide seamless digital experiences. The introduction of rewards programs, cashback offers, and discounts further fueled consumer interest. This period witnessed a surge in credit card usage, especially among the younger, tech-savvy population.

Financial Inclusion and Government Initiatives (2014 – Present):

In recent years, there has been a concerted effort towards financial inclusion, with the government and financial institutions working to bring a larger section of the population into the formal banking fold. Jan Dhan Yojana and other initiatives have played a role in increasing banking penetration, indirectly contributing to credit card adoption. Simplified application processes and lower-income eligibility criteria have made credit cards more accessible.

Innovation and Customization (Present & Future):

The current phase of the credit card market in India is marked by innovation and customization. Banks are introducing specialized cards catering to specific interests, such as travel, shopping, or dining. Fintech companies are disrupting the market with digital-first credit card offerings. Contactless payments and mobile wallets are gaining traction, reshaping how consumers perceive and use credit cards.

Fintech Companies– Entry of New Players in the Market

Fintechs have brought about a substantial transformation in the payments industry, introducing greater convenience in transactional processes. This has led customers to develop heightened expectations for enhanced experiences and services from traditional banks.

These innovative and technology-driven entities are not only reshaping the industry but also providing consumers with a diverse array of advantages while redefining the traditional norms associated with credit cards.

Innovation stands as the cornerstone of Fintech credit cards. These companies are at the forefront of introducing pioneering products that come equipped with distinctive features, setting them apart from their conventional counterparts. Examples of such innovative offerings include real-time expense tracking, instantaneous rewards, and customizable spending limits, all of which resonate strongly with a tech-savvy audience.

Speed emerges as another prominent differentiator. Fintechs leverage advanced algorithms and data analytics to facilitate swift credit assessments, resulting in approval processes that outpace those of traditional banks. This nimble and efficient approach effectively addresses the preferences of a generation that places a premium on immediacy and accessibility in financial services.

Fintech companies often adopt a targeted strategy, aiming at niche markets or underserved segments. For instance, specific Fintech credit cards are tailored to meet the unique needs of freelancers, self-employed professionals, gig economy workers, or individuals with limited credit histories. This focused approach enables them to cater precisely to the requirements of diverse consumer groups.

Collaboration stands out as a strategic imperative for Fintechs. Many strategically form partnerships with established financial institutions or credit card networks to bolster their market presence. These collaborative efforts grant Fintechs access to a broader customer base and the backing of established infrastructure.

The integration of digital wallets represents a prevalent feature among Fintech credit cards, aligning seamlessly with the growing trends of cashless and contactless payments. This cohesive integration significantly contributes to an elevated overall user experience, further enhancing the appeal of Fintech credit card offerings.

Final Takeaway

The dominance of private sector banks, the disruptive influence of Fintech entrants, and the strategic moves by traditional players collectively underscore the evolving nature of the industry.

The credit card sector in India is more than a mere transactional tool—it mirrors the adaptability of financial institutions to emerging trends and consumer preferences. The numerical shifts in market share signify strategic maneuvers, competitive positioning, and a responsive approach to the market’s changing demand.

The industry is poised for a transformative phase, characterized by increased collaboration, technological innovations, and a heightened focus on user experience. The competition for market share is a catalyst for positive change, fostering the creation of tailored products and services that align with the diverse needs of consumers.

Ultimately, understanding the dynamics of credit card market share in India is not merely an exercise in statistical analysis; it serves as a barometer for the pulse of economic activities within the nation. Each percentage point represents a strategic decision, a consumer choice, and a step forward in shaping the financial landscape.

Frequently Asked Questions (FAQs)

What is the growth rate of India’s credit card industry?

Over the past decade, the Indian credit card sector has experienced substantial growth, boasting a remarkable compound annual growth rate (CAGR) of 20% in the last four years. The count of credit cardholders surged from 29 million in March 2017 to an impressive 62 million in March 2021. Notwithstanding, the industry encountered a growth slowdown amid the COVID-19 pandemic, registering a modest 7% increase in 2020-21.

What are the revenue models for credit card issuers?

Credit card issuers typically generate revenue through diverse channels, encompassing interchange fees, annual fees, interest accrued on revolving credit, late payment charges, and foreign transaction fees.

What are the new payment products and instruments introduced by banks and financial institutions in India?

In response to the need for improved access to formal credit, banks and financial institutions are introducing innovative payment products. These encompass credit cards, buy now, pay later (BNPL) schemes, and credit EMIs. The market has witnessed disruption from new FinTech players introducing novel products and services.

What benefits do co-branded credit cards offer, and are they popular in the Indian market?

Co-branded credit cards in India often provide unique rewards, discounts, and exclusive offers in partnership with specific brands or organizations. Their popularity is on the rise as consumers seek tailored benefits aligned with their preferences and lifestyles.

How can one maximize the benefits of a credit card without accumulating debt in India?

To maximize credit card benefits while avoiding debt, individuals should budget responsibly, use credit cards for planned expenses, pay the full balance by the due date, and choose cards with features aligned with their spending habits and lifestyle.

What is cash limit in credit card?

The cash limit on a credit card represents the maximum amount of cash that a cardholder can withdraw as a cash advance from an ATM or a bank. This limit is a subset of the overall credit limit assigned to the credit card account. While the credit limit dictates the total amount available for credit card purchases, the cash limit specifically applies to cash withdrawals.

What is the safe amount of credit card debt?

Determining a “safe” amount of credit card debt depends on various factors, including an individual’s financial situation, income, expenses, and overall debt load. However, a general guideline is to keep credit card debt as low as possible and manageable. Financial experts often recommend maintaining a credit utilization ratio, which is the percentage of your credit limit that you’re currently using.

A common guideline is to keep your credit utilization below 30%. This means that if you have a credit limit of Rs10,0000, you should aim to keep your outstanding balance below Rs30,000. A lower credit utilization ratio is generally associated with better credit health and can positively impact your credit score.