FOREIGN EXCHANGE RESERVE COVER PAGE

Introduction

Foreign exchange reserves are a country’s financial assets denominated in foreign currencies and managed and maintained by its central bank or monetary authority. These reserves are very important for the economic stability of any country. Forex reserves act as a buffer against financial crises and maintain the value of the national currency. Along with this, Forex reserves ensure the ability to meet international payment obligations.

Foreign exchange reserves include foreign currency assets, gold reserves, Special Drawing Rights (SDRs), from the International Monetary Fund (IMF), and the country’s reserve position in the IMF.

Foreign exchange reserves play an important role in maintaining economic stability for a developing country like India, especially when there is global financial uncertainty. India’s journey with foreign exchange reserves has passed through significant milestones, including the economic crisis of 1991, which showed the need for robust reserves. Over the past few years, India has built up substantial reserves, making India one of the world’s leading foreign exchange reserve holders today.

Components of Foreign Exchange Reserves

Foreign exchange reserves are a country’s holdings of various types of financial assets denominated in foreign currencies. These reserves are crucial to ensuring economic stability. The key components of forex reserves are:

Foreign Currency Assets: These constitute the largest share of foreign exchange reserves. These are assets denominated in foreign currencies, mainly in the form of bonds, Treasury bills, and government securities of other countries. Foreign currency assets are used to stabilize the domestic currency, facilitate international trade, and manage the country’s balance of payments. These also provide liquidity in times of economic crises.

Gold Reserves: Gold reserves are physical gold held by the central bank. Traditionally, these have been the cornerstone of reserve holdings, but as more liquid assets such as foreign currencies have arrived, their share in total reserves has declined. Gold is considered a safe-haven asset, which provides security during global economic instability. It acts as a hedge against inflation and currency depreciation.

Special Drawing Rights (SDRs): SDRs are an international reserve asset created by the International Monetary Fund (IMF). These are allocated to member countries and can be exchanged for freely usable currencies. SDRs supplement a country’s official reserves and can be used in transactions with the IMF or other member countries. This enhances the liquidity of the country’s reserves.

Reserve Position in the International Monetary Fund (IMF): This reflects the country’s quota contribution to the IMF, which reflects its financial commitment and voting power. This includes the reserved tranche position, which is that part of the quota that can be accessed without any conditions. Reserve positions in the IMF provide an additional liquidity source. It also gives the country an opportunity to influence global financial policies and participate in international monetary cooperation.

Global Perspective on Foreign Exchange Reserves

Foreign exchange reserves are critical to the economic stability of countries around the world. It plays a key role in their ability to intervene in currency markets, manage external debt, and support their currencies during financial crises. The accumulation and management of these reserves vary from country to country, influenced by factors such as economic strategies, trade balances, and geopolitical considerations. Foreign exchange reserves play an important role in protecting a country’s economy from external shocks. This gives central banks the opportunity to intervene in the foreign exchange market to stabilize the national currency, especially when there is volatility. For example, if a country is facing a sudden capital outflow, it can buy its currency using its reserves, thus supporting its value and preventing a financial crisis. This role is especially important for emerging markets, which are more vulnerable to external economic fluctuations.

Apart from stabilizing the currency, reserves also help meet international payment obligations. This includes paying for imports, servicing foreign debt, and meeting other cross-border commitments. Holding substantial reserves instills confidence among global investors and creditors, which reduces the risk premium on borrowing and attracts foreign investment

Table 1: Foreign Exchange (FOREX) Reserves by Country

| Country | Recent Month | Preceding Month | Reference Month | Unit |

| Albania | 5518 | 5490 | Jun-24 | USD Million |

| Algeria | 64574 | 64390 | Mar-24 | USD Million |

| Angola | 14436 | 14407 | Jun-24 | USD Million |

| Argentina | 24073 | 23021 | May-24 | USD Million |

| Armenia | 3337 | 3199 | Jun-24 | USD Million |

| Australia | 53883 | 53279 | Mar-24 | USD Million |

| Austria | 34856 | 33902 | Mar-24 | USD Million |

| Azerbaijan | 11738 | 11714 | Jun-24 | USD Million |

| Bahamas | 1758 | 1673 | Mar-24 | USD Million |

| Bahrain | 5500 | 5372 | Mar-24 | USD Million |

| Bangladesh | 26815 | 24197 | Jun-24 | USD Million |

| Barbados | 770 | 772 | Mar-24 | USD Million |

| Belarus | 8358 | 8411 | Jun-24 | USD Million |

| Belgium | 82000 | 67800 | Mar-24 | USD Million |

| Belize | 281 | 277 | Mar-24 | USD Million |

| Bhutan | 597 | 641 | May-24 | USD Million |

| Bolivia | 139 | 154 | Apr-24 | USD Million |

| Bosnia & Herzegovina | 8900 | 8600 | Jun-24 | USD Million |

| Botswana | 4759 | 4898 | May-24 | USD Million |

| Brazil | 357827 | 355560 | Jun-24 | USD Million |

| Bulgaria | 35234 | 34613 | Jun-24 | USD Million |

| Burundi | 105 | 111 | Mar-24 | USD Million |

| Canada | 124205 | 122900 | Jul-24 | USD Million |

| Cape Verde | 712 | 737 | Mar-24 | USD Million |

| Chile | 44063 | 45834 | Jun-24 | USD Million |

| China | 3256000 | 3222000 | Jul-24 | USD Million |

| Colombia | 60901 | 60582 | Jun-24 | USD Million |

| Congo | 5748 | 5892 | Jun-24 | USD Million |

| Costa Rica | 13743 | 13010 | Jun-24 | USD Million |

| Croatia | 2935 | 2776 | Mar-24 | USD Million |

| Cyprus | 238 | 248 | Jun-24 | USD Million |

| Czech Republic | 147949 | 146500 | Jul-24 | USD Million |

| Denmark | 81610 | 80096 | May-24 | USD Million |

| Dominican Republic | 13391 | 13938 | Jun-24 | USD Million |

| Ecuador | 7090 | 6740 | Jun-24 | USD Million |

| Egypt | 46490 | 46380 | Jul-24 | USD Million |

| El Salvador | 3250 | 3119 | May-24 | USD Million |

| Finland | 8177 | 8080 | Jun-24 | USD Million |

| France | 240677 | 238277 | Mar-24 | USD Million |

| Georgia | 3587 | 3601 | Jun-24 | USD Million |

| Germany | 339800 | 320553 | Mar-24 | USD Million |

| Ghana | 6594 | 5991 | Apr-24 | USD Million |

| Greece | 3926 | 3819 | Mar-24 | USD Million |

| Guatemala | 21412 | 21671 | Jun-24 | USD Million |

| Guinea | 1725 | 1816 | Aug-23 | USD Million |

| Guyana | 712 | 927 | Jun-24 | USD Million |

| Honduras | 6843 | 6964 | Jun-24 | USD Million |

| Hong Kong | 419300 | 416300 | Jun-24 | USD Million |

| Hungary | 41344 | 36595 | Mar-24 | USD Million |

| Iceland | 6847 | 6823 | Mar-24 | USD Million |

| India | 674920 | 667390 | Aug-24 | USD Million |

| Indonesia | 145400 | 140177 | Jul-24 | USD Million |

| Iraq | 100000 | 115000 | Mar-24 | USD Million |

| Ireland | 12599 | 12729 | Mar-24 | USD Million |

| Israel | 213634 | 210281 | Jul-24 | USD Million |

| Italy | 247748 | 238866 | Apr-24 | USD Million |

| Jamaica | 5053 | 5102 | May-24 | USD Million |

| Japan | 1219100 | 1231500 | Jul-24 | USD Million |

| Jordan | 18765 | 18578 | Mar-24 | USD Million |

| Kazakhstan | 39933 | 39817 | Jun-24 | USD Million |

| Kenya | 15328 | 15966 | Mar-24 | USD Million |

| Kuwait | 42455 | 44002 | May-24 | USD Million |

| Kyrgyzstan | 3784 | 3719 | Jun-24 | USD Million |

| Laos | 1858 | 1777 | Mar-24 | USD Million |

| Latvia | 4711 | 4620 | Jun-24 | USD Million |

| Lithuania | 5474 | 5370 | Jun-24 | USD Million |

| Luxembourg | 1119 | 1153 | Mar-24 | USD Million |

| Macau | 28880 | 28364 | Jun-24 | USD Million |

| Macedonia | 4129 | 4136 | Jun-24 | USD Million |

| Malawi | 488 | 471 | Mar-24 | USD Million |

| Malaysia | 113800 | 113600 | Jun-24 | USD Million |

| Maldives | 509 | 492 | Jun-24 | USD Million |

| Mauritius | 8192 | 7730 | Jun-24 | USD Million |

| Mexico | 225876 | 222774 | Jun-24 | USD Million |

| Moldova | 5468 | 5271 | Jul-24 | USD Million |

| Mongolia | 4839 | 5183 | Jun-24 | USD Million |

| Morocco | 32037 | 31824 | Mar-24 | USD Million |

| Mozambique | 3601 | 3422 | Jan-24 | USD Million |

| Namibia | 2019 | 2044 | Mar-24 | USD Million |

| Netherlands | 125451 | 125239 | Mar-24 | USD Million |

| New Zealand | 31712 | 29796 | Mar-24 | USD Million |

| Nicaragua | 5490 | 5484 | Jun-24 | USD Million |

| Nigeria | 34070 | 32690 | Jun-24 | USD Million |

| Norway | 71901 | 71571 | Mar-24 | USD Million |

| Oman | 16163 | 15615 | Mar-24 | USD Million |

| Pakistan | 14573 | 13652 | Jun-24 | USD Million |

| Papua New Guinea | 3413 | 3555 | May-24 | USD Million |

| Paraguay | 9140 | 9029 | Jun-24 | USD Million |

| Peru | 73967 | 74062 | Mar-24 | USD Million |

| Philippines | 105648 | 105189 | Jun-24 | USD Million |

| Poland | 214324 | 209569 | Jul-24 | USD Million |

| Portugal | 53710 | 61510 | Mar-24 | USD Million |

| Qatar | 64560 | 55629 | Mar-24 | USD Million |

| Romania | 77364 | 84862 | Mar-24 | USD Million |

| Russia | 602050 | 593498 | Jul-24 | USD Million |

| Saudi Arabia | 442917 | 455205 | May-24 | USD Million |

| Serbia | 26298.3 | 24117.9 | Jun-24 | USD Million |

| Seychelles | 747 | 751 | Jun-24 | USD Million |

| Singapore | 506434 | 503711 | Jul-24 | USD Million |

| Slovakia | 12890 | 12566 | Jun-24 | USD Million |

| Slovenia | 2519 | 2457 | Mar-24 | USD Million |

| South Africa | 62270 | 62100 | Jul-24 | USD Million |

| South Korea | 413510 | 412210 | Jul-24 | USD Million |

| Spain | 94341 | 99826 | Mar-24 | USD Million |

| Sri Lanka | 5605 | 5368 | Jun-24 | USD Million |

| Sweden | 59568 | 60410 | Mar-24 | USD Million |

| Switzerland | 795438 | 794311 | Mar-24 | USD Million |

| Taiwan | 573299 | 572803 | Jul-24 | USD Million |

| Thailand | 224329 | 224334 | Jun-24 | USD Million |

| Trinidad & Tobago | 5983 | 5415 | Jun-24 | USD Million |

| Tunisia | 8623 | 8084 | Mar-24 | USD Million |

| Turkey | 92490 | 91910 | Aug-24 | USD Million |

| Uganda | 3234 | 3259 | Jun-24 | USD Million |

| Ukraine | 37200 | 37900 | Jul-24 | USD Million |

| United Arab Emirates | 151600 | 148060 | Mar-24 | USD Million |

| United Kingdom | 182607 | 184459 | Jun-24 | USD Million |

| United States | 35243 | 35758 | Jun-24 | USD Million |

| Uruguay | 18111 | 17840 | Jun-24 | USD Million |

| Uzbekistan | 37402 | 36341 | Jul-24 | USD Million |

| Venezuela | 10308 | 10125 | Jun-24 | USD Million |

| Vietnam | 93342 | 94583 | Mar-24 | USD Million |

| Zambia | 3504 | 3556 | Apr-24 | USD Million |

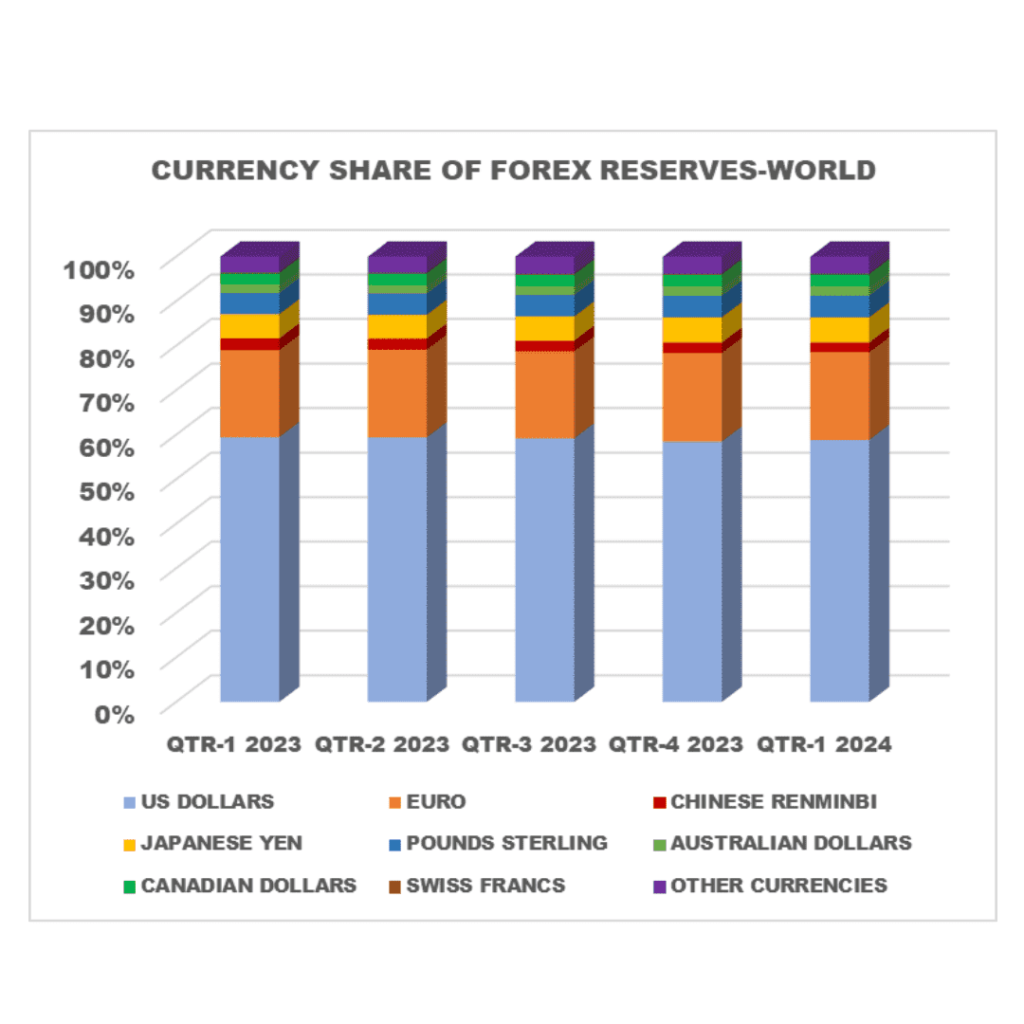

Table 2: Currency Share of FOREX Reserves- World

| CURRENCY SHARE OF FOREX RESERVES- WORLD (USD BILLION) | |||||

| CURRENCY | QTR-1 2023 | QTR-2 2023 | QTR-3 2023 | QTR-4 2023 | QTR-1 2024 |

| US DOLLARS | 6631 | 6640 | 6497 | 6694 | 6767 |

| EURO | 2183 | 2204 | 2147 | 2284 | 2263 |

| CHINESE RENMINBI | 288 | 273 | 261 | 262 | 247 |

| JAPANESE YEN | 608 | 600 | 601 | 651 | 654 |

| POUNDS STERLING | 531 | 533 | 528 | 557 | 562 |

| AUSTRALIAN DOLLARS | 222 | 220 | 223 | 245 | 248 |

| CANADIAN DOLLARS | 272 | 280 | 275 | 296 | 295 |

| SWISS FRANCS | 28 | 21 | 20 | 23 | 22 |

| OTHER CURRENCIES | 389 | 405 | 426 | 441 | 438 |

| ALLOCATED RESERVES | 11152 | 11176 | 10977 | 11453 | 11497 |

| UNALLOCATED RESERVES | 874 | 874 | 868 | 889 | 852 |

| TOTAL RESERVES | 12026 | 12050 | 11846 | 12342 | 12350 |

| SOURCE: INTERNATIONAL MONETARY FUND | |||||

The US Dollar (USD) remains the dominant reserve currency, consistently holding the largest share of global reserves. The USD reserves increased from $6,631 billion in Q1 2023 to $6,767 billion in Q1 2024. This reflects the sustained confidence in the dollar, despite periodic fluctuations. The slight dip in Q3 2023 to $6,497 billion suggests a temporary shift, possibly due to global economic adjustments or central bank interventions. However, the subsequent rebound indicates resilience and continued reliance on the USD as the primary reserve currency.

The Euro (EUR) has maintained its position as the second-largest reserve currency, with reserves fluctuating between $2,183 billion in Q1 2023 and $2,263 billion in Q1 2024. The minor decrease in Q3 2023 to $2,147 billion could be attributed to regional economic uncertainties or adjustments in central bank portfolios. Nevertheless, the Euro’s reserve holdings exhibit a stable trajectory, reinforcing its role as a key reserve currency, particularly in regions with close economic ties to the Eurozone.

The Chinese Renminbi (CNY) shows a notable decline in reserve holdings from $288 billion in Q1 2023 to $247 billion in Q1 2024. This downward trend suggests a cautious approach by global central banks toward the Renminbi, potentially driven by concerns over China’s economic outlook, trade tensions, or regulatory environment. The decline highlights the challenges the Renminbi faces in gaining broader acceptance as a global reserve currency despite China’s significant economic influence.

The Japanese Yen (JPY) and the British Pound Sterling (GBP) both demonstrate relative stability with slight increases in reserve holdings over the period. The JPY rose from $608 billion in Q1 2023 to $654 billion in Q1 2024, while the GBP increased from $531 billion to $562 billion over the same period. These currencies continue to be important components of global reserves, likely due to the economic stability of Japan and the UK and their roles in international trade and finance.

The Australian Dollar (AUD) and Canadian Dollar (CAD) show moderate increases, with the AUD rising from $222 billion in Q1 2023 to $248 billion in Q1 2024, and the CAD from $272 billion to $295 billion. These gains suggest growing confidence in these currencies, possibly due to strong commodity markets and stable economic conditions in their respective countries.

Swiss Franc (CHF) holdings remain minimal, declining slightly from $28 billion in Q1 2023 to $22 billion in Q1 2024, reflecting its niche role as a reserve currency, often associated with stability and safe-haven status.

Graph 1: World Foreign Exchange Reserves by Currency

India’s Forex Reserves

In the years after independence, India’s foreign exchange reserves were modest because, at that time, the country’s focus was on import substitution and exports were limited. Reserves were used only to meet short-term import requirements, and the economy was largely dependent on agricultural exports and foreign aid.

The 1960s and 1970s were challenging decades for India, marked by wars, droughts, and oil price shocks. Along with these factors, the country had to face problems like slow economic growth and balance of payments crises. At this time, forex reserves are always low, which limits them to covering imports for only a few weeks. Lack of sufficient reserves was making India vulnerable to external shocks.

In the 1980s, India’s economic policies remained inward-looking and focused on state-led industrialization. However, the economy continued to grow rapidly, but fiscal deficits widened, leading to a deterioration of the current account. Foreign exchange reserves remained under constant pressure, making the economic situation more precarious by the end of the decade.

The 1991 Balance of Payments Crisis: A Turning Point

By the 1990s, India was teetering on the brink of a severe balance of payments crisis. Due to the Second Gulf War, oil prices increased rapidly, which increased the current account deficit. By mid-1991, India’s foreign exchange reserves had fallen to less than $1 billion, which was only enough to cover two weeks’ worth of imports. The country was on the verge of defaulting on its international obligations.

This crisis forced India to seek help from the International Monetary Fund (IMF) and keep gold as collateral for loans. This period proved to be a turning point in India’s economic policy. Under the leadership of Prime Minister P.V. Narasimha Rao and Finance Minister Dr.Manmohan Singh, the government initiated sweeping economic reforms to liberalize the economy, reduce the fiscal deficit, and improve exports. These reforms laid the foundation for the accumulation of foreign exchange reserves in the coming years.

1990s to Early 2000s: The Era of Accumulation

After the crisis of 1991, India’s economy started growing rapidly. The liberalization policy of trade, foreign investment, and the financial sector led to a tremendous increase in capital inflows in India. This trend started, especially in foreign direct investment (FDI) and portfolio investment. Along with this, the growth of the information technology (IT) and services sectors contributed to the huge increase in foreign exchange reserves.

By the late 1990s, India’s reserves had grown substantially, crossing $30 billion by the end of the decade. The Reserve Bank of India (RBI) adopted a policy of actively managing the reserves, and intervening in the foreign exchange market to stabilize the rupee and prevent excessive volatility.

2000s: The Boom Years

India became more integrated into the global economy in the early 2000s. The IT boom and robust growth in exports, remittances, and capital inflows contributed significantly to the rapid accumulation of reserves. By 2004, India’s foreign exchange reserves had crossed $100 billion.

During the global financial crisis of 2008, India’s reserves played a vital role in mitigating the impact on the economy. Due to capital outflow and rupee depreciation, reserves slightly declined, but forex reserves remained substantial enough to maintain investor confidence and support the currency.

Foreign Exchange Reserves Under Modi:1, Modi:2 and Modi:3 Government

Initial Years (2014-2016): Steady Accumulation Amid Global Challenges

When Narendra Modi took office in 2014, India’s foreign exchange reserves stood at approximately $313 billion. This was already a substantial amount, reflecting the country’s recovery from the 2008 global financial crisis and the subsequent period of economic stability.

The global economic environment has remained relatively stable since the beginning of the Modi government, although challenges like fluctuating oil prices and slowing global growth have created some risks. Despite these challenges, India’s foreign exchange reserves continued to increase at a steady pace, reaching approximately $360 billion by the end of 2016. The government’s focus was on improving the ease of doing business, attracting foreign investment, and implementing key economic reforms, which contributed to growth.

The Modi government has introduced major economic reforms during this period, which include the Goods and Services Tax (GST), the Make in India initiative, and reforms in the financial sector. These measures improved investor confidence and boosted foreign direct investment (FDI) and portfolio inflows, which boosted reserves.

2017-2019: Robust Growth and Economic Resilience

Between 2017 and 2019, India began to see significant growth in its foreign exchange reserves. Reserves crossed the $400 billion mark in 2017, and by the end of 2019, they had reached approximately $430 billion. This period saw strong capital inflows, particularly in the form of FDI, and a stable current account deficit. The government’s infrastructure development project and promotion of digitalization also contributed significantly to attracting foreign investment.

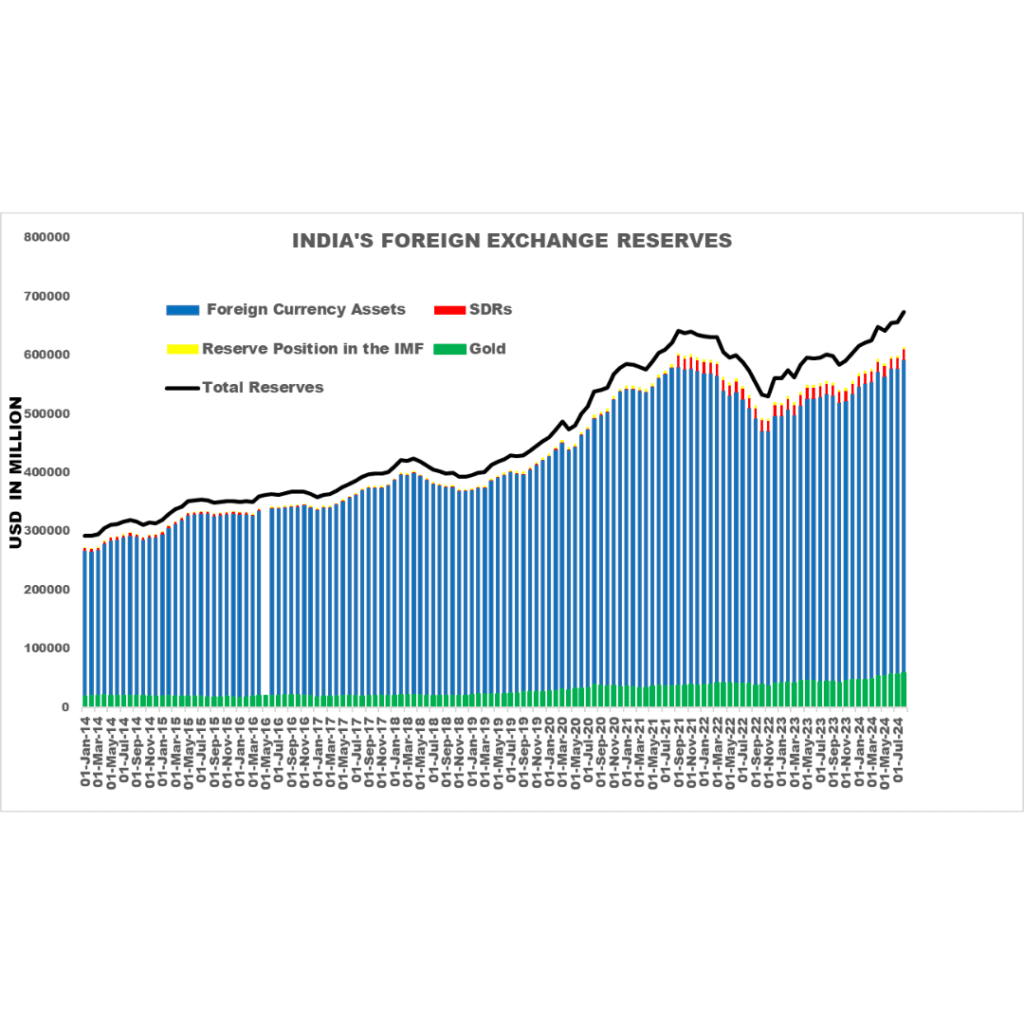

Graph 2: India’s Foreign Exchange Reserve – Growth and Composition from Jan 2014 to July 2024

The Reserve Bank of India (RBI) played an active role in managing the rupee’s value during this period, using the growing reserves to intervene in the forex market and prevent excessive volatility. This helped maintain the stability of the Indian currency and ensured a favorable environment for foreign investors.

The global economy faced uncertainties during this period, including trade tensions between the US and China, and fluctuations in international crude oil prices. Despite these challenges, India’s reserves continued to grow, reflecting the resilience of the Indian economy and the effectiveness of the government’s economic policies.

2020-2021: Resilience Amid the COVID-19 Pandemic

The COVID-19 pandemic, which began in early 2020, posed an unprecedented challenge to the global economy. In India, the pandemic led to a sharp economic contraction in 2020, with significant disruptions to trade, investment, and domestic economic activity. Despite these challenges, India’s foreign exchange reserves continued to grow, surpassing $500 billion in mid-2020.

The Modi government and the RBI implemented a series of measures to mitigate the economic impact of the pandemic. The RBI’s accommodative monetary policy, including interest rate cuts and liquidity injections, helped stabilize the financial markets. Additionally, the government’s economic stimulus packages aimed at supporting businesses and vulnerable sections of the population helped sustain investor confidence.

By the end of 2021, India’s foreign exchange reserves had reached a record high of approximately $640 billion. This growth was driven by strong capital inflows, particularly in the form of FDI and foreign portfolio investment (FPI), as well as a rebound in exports. The RBI’s prudent management of reserves, including diversification into various assets and currencies, also contributed to this increase.

2022-2024: Global Uncertainties

The period from 2022 to 2024 was marked by significant global economic challenges, including geopolitical tensions, rising inflation, and tightening monetary policies in major economies. These factors led to increased volatility in global financial markets and posed risks to emerging economies like India.

Despite these challenges, India’s foreign exchange reserves remained robust, fluctuating between $560 billion and $620 billion during this period. The RBI continued to manage the reserves actively, using them to stabilize the rupee and prevent excessive volatility in the forex market. The government’s focus on fiscal prudence and economic reforms also helped maintain investor confidence and support capital inflows.

As of August 2024, India’s foreign exchange reserves crossed $674 billion, making it one of the largest in the world. These reserves provide a strong buffer against external shocks and ensure the stability of the Indian economy in an increasingly uncertain global environment.

India’s Foreign Exchange Management

India’s foreign exchange management is a cornerstone of its macroeconomic policy, playing a pivotal role in safeguarding the country’s financial stability and supporting its growth trajectory. As one of the world’s largest emerging economies, India’s approach to managing its foreign exchange reserves and currency markets is complex and dynamic, designed to navigate the challenges posed by global economic volatility and domestic economic imperatives.

Strategic Reserve Accumulation and Management

India’s foreign exchange reserves have grown substantially over the past three decades, evolving from a position of vulnerability in the early 1990s to one of the world’s largest reserve holdings. The Reserve Bank of India (RBI), the custodian of these reserves, follows a meticulously crafted strategy that balances safety, liquidity, and return.

- Safety and Liquidity: The RBI prioritizes the security of its reserve assets, predominantly investing in high-quality sovereign bonds, primarily denominated in US dollars. This strategy ensures that reserves are readily accessible to address the balance of payments needs and manage external shocks. The reserves also include gold and Special Drawing Rights (SDRs) from the International Monetary Fund (IMF), which serve as additional layers of diversification and security.

- Return Optimization: While safety and liquidity are paramount, the RBI also seeks to optimize returns within the constraints of its risk management framework. This involves the selection of instruments and currencies that offer favorable yields without compromising the core objectives of reserve management.

Exchange Rate Policy: Managed Flexibility

India operates a managed float exchange rate system, wherein the rupee’s value is predominantly determined by market forces, but with occasional interventions by the RBI to curb excessive volatility. This approach allows India to maintain flexibility in responding to external shocks while avoiding abrupt currency fluctuations that could destabilize the economy.

- Market Intervention: The RBI intervenes in the foreign exchange market through the buying and selling of foreign currencies to smoothen excessive volatility in the rupee. These interventions are typically sterilized to mitigate any inflationary effects, ensuring that monetary policy objectives are not compromised.

- Exchange Rate Stability vs. Competitiveness: The challenge for the RBI is to maintain a balance between ensuring exchange rate stability and preserving the competitiveness of Indian exports. A stable rupee is crucial for maintaining investor confidence and controlling imported inflation, while a competitive exchange rate supports export growth and helps in managing trade deficits.

Capital Account Management: A Calibrated Approach

India’s capital account management is characterized by a calibrated approach, allowing for a gradual liberalization of capital flows while maintaining safeguards against potential vulnerabilities. The framework governing capital flows is designed to attract stable, long-term investments while minimizing the risks associated with volatile capital movements.

- Foreign Direct Investment (FDI) and Portfolio Investment: India has progressively liberalized its FDI policies to attract foreign investment in key sectors. Simultaneously, the management of portfolio investments involves monitoring short-term capital flows to prevent excessive volatility in financial markets. The use of limits, ceilings, and sectoral caps on investments are tools employed to regulate the nature and pace of capital inflows.

- External Borrowing: The regulation of external commercial borrowings (ECBs) is another critical aspect of India’s capital account management. The RBI, in coordination with the government, sets guidelines on the amount, tenor, and end-use of these borrowings to ensure that external debt remains sustainable and does not pose a risk to macroeconomic stability.

Debt Management: Ensuring Sustainability

India’s approach to external debt management is underpinned by principles of sustainability and prudence. The RBI and the Ministry of Finance monitor key indicators such as the external debt-to-GDP ratio, debt service ratio, and short-term debt as a proportion of total debt to ensure that the country’s debt obligations remain within manageable limits.

- Composition of Debt: India’s external debt is predominantly long-term, which reduces rollover risks and aligns with the country’s development financing needs. The preference for long-term debt instruments also reflects a strategic choice to minimize exposure to short-term market volatilities.

- Debt Servicing: Adequate foreign exchange reserves are maintained to cover external debt obligations, enhancing India’s creditworthiness and ensuring that the country can meet its international commitments without strain. This conservative approach to debt servicing contributes to investor confidence and stable sovereign ratings.

Policy Framework: Legal and Institutional Foundations

India’s foreign exchange management is governed by a robust legal and institutional framework that provides the necessary flexibility to adapt to changing global and domestic conditions. The Foreign Exchange Management Act (FEMA) of 1999, which replaced the more restrictive Foreign Exchange Regulation Act (FERA), marked a significant shift towards a more liberalized and market-oriented approach.

- Regulatory Oversight: The RBI, under the aegis of FEMA, has the authority to regulate foreign exchange transactions, manage foreign exchange reserves, and intervene in the currency markets. The Act provides the legal basis for the RBI’s operations, ensuring that foreign exchange management aligns with broader economic objectives.

- Coordination with Fiscal Policy: There is a strong alignment between India’s foreign exchange management and its fiscal policies. The government and the RBI work in tandem to ensure that foreign exchange management supports macroeconomic stability, inflation control, and sustainable growth. This coordination is particularly evident in the management of external borrowings and the use of foreign exchange reserves for strategic purposes.

Mitigating External Vulnerabilities

India’s foreign exchange management strategy includes measures to mitigate the impact of external vulnerabilities such as global financial crises, commodity price shocks, and geopolitical risks. The accumulation of foreign exchange reserves serves as a buffer against these risks, enabling the country to maintain stability in the face of external shocks.

- Crisis Management: The strategic use of reserves during periods of global financial instability, such as the 2008 financial crisis and the COVID-19 pandemic, has been instrumental in maintaining economic stability. The ability to deploy reserves to stabilize the currency and manage external payments underscores the importance of a robust reserve management strategy.

- Trade and Current Account Management: India’s foreign exchange management is closely linked to its trade policy, with an emphasis on managing the current account deficit (CAD) to sustainable levels. A focus on export competitiveness, coupled with the careful monitoring of import bills, particularly concerning oil and gold, helps in maintaining a balanced external sector.