Introduction

In the dynamic landscape of India’s financial ecosystem, the winds of change are palpable, ushering in an era marked by the unprecedented growth of digital transactions. At the forefront of this transformative wave stands the Unified Payment Interface (UPI, a groundbreaking system that has redefined how financial transactions unfold in the country. From the dusty by-lanes of rural villages to the bustling urban hubs, the ascent of digital transactions and the omnipresence of UPI have become emblematic of India’s journey towards a cashless future.

The advent of UPI marks a significant milestone in India’s journey towards a cashless economy. Born out of the need for a seamless, interoperable, and instant payment system, UPI has swiftly emerged as a game-changer, streamlining financial transactions across the country. Its inception has not only reshaped the financial sector but has also catalyzed a digital payment revolution, empowering individuals and businesses to conduct transactions with unprecedented ease and efficiency.

Developed by the National Payments Corporation of India (NPCI), UPI has evolved into a simple yet powerful platform that unifies diverse banking services under a single umbrella. Its architecture is designed to provide a secure, user-friendly, and real-time payment experience, enabling users to transfer funds, pay bills, and conduct various financial activities with remarkable convenience.

Digital Payments in India

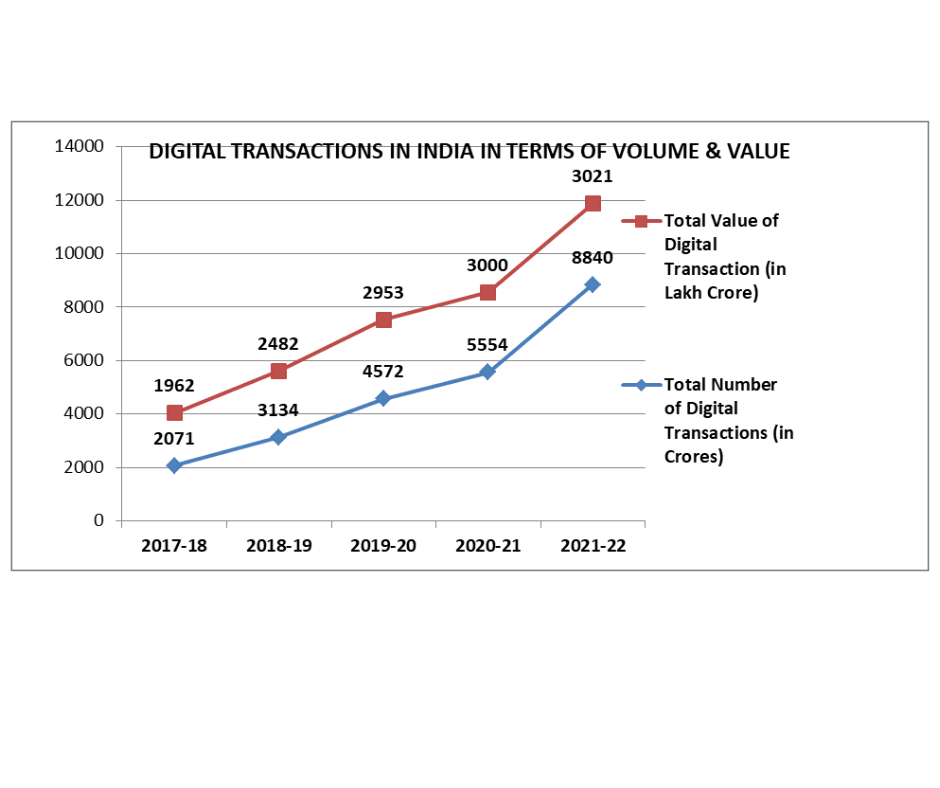

| DIGITAL TRANSACTIONS IN VOLUME AND VALUE IN INDIA | ||

| Financial Year | Total Number of Digital Transactions (in Crores) | Total Value of Digital Transaction (in Lakh Crore) |

| 2017-18 | 2071 | 1962 |

| 2018-19 | 3134 | 2482 |

| 2019-20 | 4572 | 2953 |

| 2020-21 | 5554 | 3000 |

| 2021-22 | 8840 | 3021 |

| SOURCE: RBI | ||

The data reveals a consistent and notable growth trend in both the volume and value of digital transactions in India over the past five financial years. Starting at 2071 crore transactions and INR 1962 lakh crore in the financial year 2017-18, the numbers have steadily increased, reaching 8840 crore transactions and INR 3021 lakh crore in 2021-22.

The compound annual growth rate (CAGR) for digital transactions’ volume stands at approximately 33.67%, while the CAGR for the value of transactions is around 11.89%. This suggests a significantly higher transaction volume growth rate than transaction value over the specified period.

In the financial year 2020–21, we have witnessed a substantial increase in both volume and value, which can be attributed, in part, to the COVID-19 pandemic. The lockdowns and safety concerns prompted a surge in online transactions and digital payments, accelerating the shift towards a cashless economy.

The continuous growth in digital transactions indicates an increasing adoption and acceptance of digital payment methods among the Indian population. This is likely influenced by factors such as government initiatives, advancements in digital infrastructure, and a growing awareness of the benefits of digital transactions.

Government-led initiatives, including demonetization in 2016 and subsequent campaigns promoting digital payments, have played a pivotal role in shaping the digital payment landscape in India. The consistent growth in digital transactions aligns with the government’s vision of a less-cash economy.

Digital Payment Index

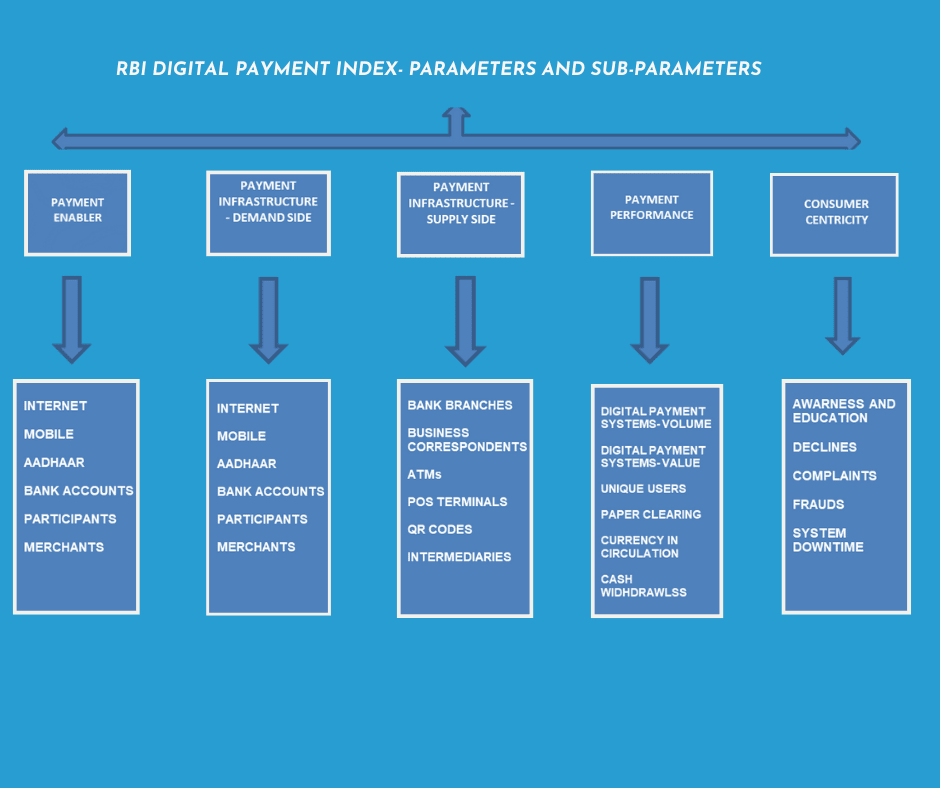

As per the announcement outlined in the Statement on Developmental and Regulatory Policies within the Sixth Bi-monthly Monetary Policy Statement for 2019-20, dated February 06, 2020, the Reserve Bank of India has devised a comprehensive Digital Payments Index (DPI) aimed at measuring the level of digitization in payment systems in India.

The RBI-Digital Payment Index is structured around five broad parameters designed to assess the growth and prevalence of digital payments across different timeframes. These parameters encompass: (i) Payment Enablers (weighted at 25%), (ii) Payment Infrastructure—demand-side factors (10%), (iii) Payment Infrastructure—supply-side factors (15%), (iv) Payment Performance (45%), and (v) Consumer Centricity (5%). Each of these parameters includes sub-parameters, each comprising various measurable indicators.

The RBI Digital Payment Index is calculated on the basis of the following parameters and sub-parameters:

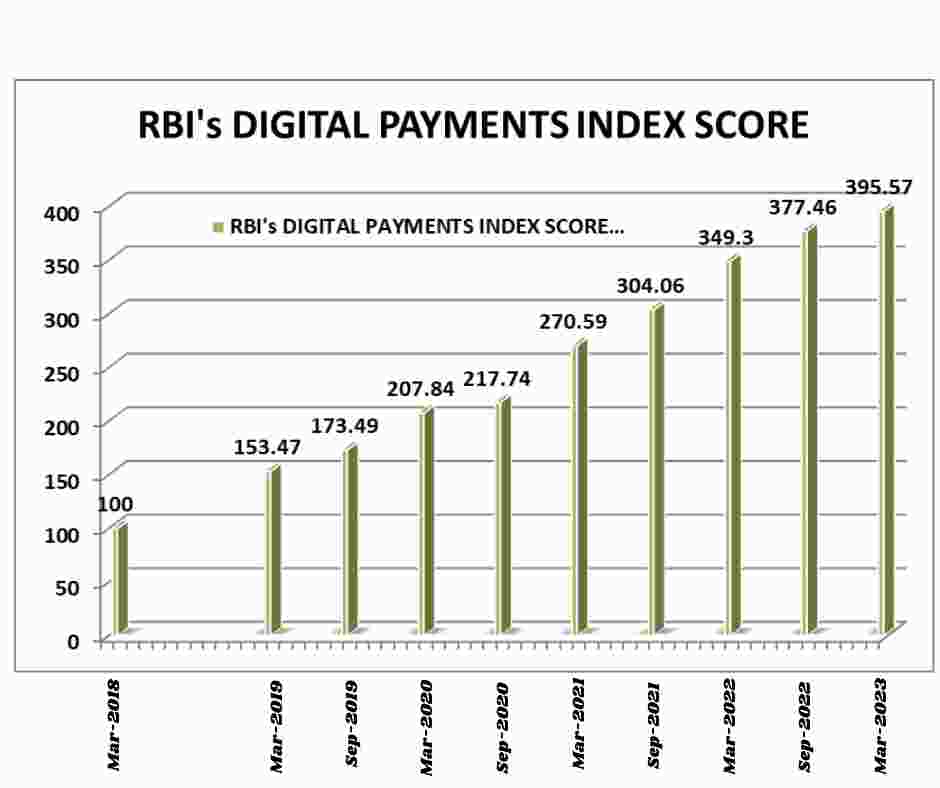

| RBI’s DIGITAL PAYMENTS INDEX SCORE | |

| Month/ Year | Index Score |

| Mar-18 | 100 |

| Mar-19 | 153.47 |

| Sep-19 | 173.49 |

| Mar-20 | 207.84 |

| Sep-20 | 217.74 |

| Mar-21 | 270.59 |

| Sep-21 | 304.06 |

| Mar-22 | 349.30 |

| Sep-22 | 377.46 |

| Mar-23 | 395.57 |

| Source: RBI | |

The Digital Payments Index (DPI) started at a baseline of 100 in March 2018, serving as the initial benchmark for evaluating the subsequent growth and evolution of digital payments.

From March 2018 to March 2019, the DPI showed a noteworthy increase from 100 to 153.47, indicating a positive annual growth in the adoption and performance of digital payments. The upward trajectory continued in September 2019, reaching an index score of 173.49, showcasing sustained growth in the digitization of payments.

Despite global challenges in March 2020, the DPI spiked to 207.84, underscoring the resilience and increasing reliance on digital payment methods during unprecedented times. The positive momentum persists into September 2020, with the DPI climbing to 217.74, suggesting that digital payments continue to play an increasingly crucial role in the financial landscape.

March 2021 marks a significant leap, with the DPI soaring to 270.59, indicating substantial growth and widespread acceptance of digital payment solutions. This upward trajectory continues in September 2021, with the DPI reaching 304.06, reinforcing the continuous expansion and integration of digital transactions into the mainstream.

March 2022 witnesses a DPI of 349.3, signaling accelerated growth in digital payments, potentially driven by technological advancements, increased adoption, and favorable regulatory environments. The positive trend persists in September 2022 as the DPI climbs to 377.46, showcasing sustained momentum and solidifying digital payments as a cornerstone of the financial ecosystem.

The latest available data in March 2023 reveals a DPI of 395.57, emphasizing the enduring and robust nature of digital payments in India.

What is the Unified Payment Interface (UPI)?

The Unified Payments Interface (UPI) is a real-time payment system and an innovative digital payment platform developed by the National Payments Corporation of India (NPCI). UPI allows users to link multiple bank accounts and perform various financial transactions through a single mobile application. It has played a pivotal role in simplifying and enhancing the way payments are made in India.

To make payments through UPI, various identification methods can be used, including a UPI ID, UPI number, account number, and the Indian Financial System Code (IFSC). Payment security adheres to the relevant RBI regulations and employs a 1-click 2-factor authentication system, where the UPI PIN serves as the second authentication factor. Additionally, UPI is accessible via the Unstructured Supplementary Services Data (USSD) channel, making it inclusive for users of feature phones and widening its reach.

Unique Features of Unified Payment Interface (UPI)

- UPI allows users to access and manage multiple bank accounts from different banks through a single UPI-enabled mobile app.

- UPI ensures instant fund transfers and payments, making it one of the quickest modes of transferring money.

- UPI services are available around the clock, providing users with the flexibility to perform transactions at any time.

- UPI uses virtual payment addresses (VPAs) that eliminate the need to share sensitive bank account details. Users can send money by simply using a VPA.

- Users can link multiple bank accounts within the UPI app, making it convenient for those who hold accounts in various banks.

- UPI supports the payment of utility bills, such as electricity, water, and gas bills, directly through the app.

- Users can pay for goods and services at physical stores or online by scanning QR codes or entering merchant details.

- UPI enables users to send payment requests to friends, family, or colleagues, which can be scheduled and paid at their convenience.

- UPI transactions are secured with two-factor authentication to protect users’ financial information and funds.

- UPI has played a vital role in promoting financial inclusion by providing access to digital financial services, even in remote and underserved areas.

- The UPI ecosystem has evolved with UPI 2.0, introducing additional features like overdraft facilities, one-time mandates, and more, further enhancing the user experience.

Participants in Unified Payment Interface (UPI)

The Unified Payments Interface (UPI) involves various participants, each playing a unique role in the UPI ecosystem. Here are the key participants in the UPI system:

Customers:

Customers are individuals or entities with bank accounts who use UPI-enabled mobile apps to initiate and receive transactions. They link their bank accounts to the UPI app and use features like fund transfers, bill payments, and merchant transactions.

Banks:

Banks play a central role in the UPI ecosystem. They provide the underlying infrastructure and support for UPI transactions. Banks facilitate the registration of customers for UPI services and ensure the security and integrity of transactions.

Payment Service Providers (PSPs):

Payment service providers act as intermediaries between customers and banks. They develop UPI-enabled mobile apps and provide the platform through which users interact with the UPI system. PSPs are often non-banking entities that collaborate with banks to offer UPI services.

National Payments Corporation of India (NPCI):

The NPCI is the organization responsible for managing and governing the UPI framework. It creates and maintains the UPI platform, establishes rules and standards, and oversees the entire UPI ecosystem to ensure its smooth operation.

Merchants and billers:

Merchants and billers are entities that accept payments through UPI. Customers can use UPI to pay for goods and services, utility bills, and other expenses. Merchants and billers receive the payments directly into their bank accounts.

Payment Gateways:

Payment gateways provide the technology that facilitates online transactions between customers and merchants. When customers make online purchases using UPI, payment gateways process the transactions and ensure secure payment processing.

Aadhaar Enabled Payment System (AEPS) Providers:

AEPS providers integrate UPI with Aadhaar-based transactions, enabling customers to access banking services and make transactions using their Aadhaar numbers and biometric authentication.

Third-Party Service Providers:

Various third-party service providers, such as insurance companies, investment platforms, and fintech companies, integrate with UPI to offer additional financial services and products to customers.

How does the Unified Payment Interface (UPI) work?

Registration:

- To use UPI, you need to have a bank account with a bank that supports UPI services.

- Download a UPI-enabled mobile app from your bank or a third-party UPI app from the app stores.

- Link your bank account by providing your account details and setting up a Unified Payments Interface PIN (UPI-PIN). This PIN serves as your authentication code for UPI transactions.

Setting up a Virtual Payment Address (VPA):

- During the registration process, you’ll create a virtual payment address (VPA). This is a unique identifier that replaces your bank account number and simplifies transaction initiation.

- Your VPA typically looks like “yourname@bankname.”

Initiating Transactions:

- To send money, initiate a payment, or make transactions using UPI, log in to your UPI-enabled mobile app.

- Select the “Send Money” or equivalent option.

- Enter the recipient’s VPA or mobile number, or scan their UPI QR code.

Transaction Verification:

- Input the transaction amount.

- Optionally, you can add remarks or specify the purpose of the transaction.

Authentication:

- To confirm the transaction, you’ll be asked to enter your UPI-PIN, which serves as two-factor authentication.

- Once the UPI-PIN is entered correctly, the transaction is authorized and sent for processing.

Processing the transaction:

- The UPI system processes the transaction in real time. It debits the amount from your bank account and transfers it to the recipient’s account.

Transaction Status and Confirmation:

- You’ll receive a transaction status message, typically in the form of a notification on your mobile app.

- The recipient will also be notified of the incoming funds.

Payment to Merchants and Billers:

- To make payments to merchants or billers, you can scan their UPI QR code or enter their VPA.

- After confirming the payment, the funds are transferred to the merchant’s or biller’s account.

Request for Payment:

- You can send payment requests to others using their VPA. These requests can be scheduled for a later date or paid immediately by the recipient.

Checking transaction history:

- Your UPI app maintains a transaction history, allowing you to review past transactions and payment details.

Security Measures:

- UPI transactions are secured with end-to-end encryption and the UPI-PIN, ensuring the safety of your financial information and funds.

Support for Multiple Banks:

- UPI is designed for interoperability, so you can manage accounts from multiple banks through a single UPI-enabled app.

Benefits of UPI

- Convenience: easy and unified access to multiple bank accounts in one app.

- Real-Time Transactions: Instant money transfers 24/7.

- Accessibility: It operates round the clock, including weekends and holidays.

- Simplified Payment Process: No need to share sensitive bank details; use a Virtual Payment Address (VPA) or QR code.

- Enhanced Security: Two-factor authentication with a mobile PIN or biometric verification

- Financial Inclusion: Widens access to digital payments, including for underserved populations.

- Reduced Cash Reliance: Encourages less use of physical currency.

- Bill Payments: Utility bills, tickets, online shopping, and food orders can be paid through UPI.

- Cost-effective: lower or no transaction fees compared to traditional methods.

- Environmentally Friendly: Reduces the environmental impact of physical currency.

- Transparency: Provides an electronic record of transactions for budgeting and accounting.

- Global Accessibility: Influences other countries to adopt similar payment systems.

- Ease of Integration: Businesses can incorporate UPI into their payment systems.

- Innovation and Competition: Drives fintech innovation and improves services

- Contactless Payments: Supports contactless transactions for retail and in-person payments.

Market Size: Unified Payment Interface

Technavio:

According to Market Research Company, Technavio, the market share of the Unified Payments Interface (UPI) in India is projected to grow to USD 65.49 trillion between 2021 and 2026, with a compound annual growth rate (CAGR) of 132.98%.

As per the findings of Technavio, the expansion of the UPI market in India is propelled by swift and seamless money transfer procedures. Built upon the IMPS platform, UPI grants users the freedom to initiate payments at their convenience, without constraints on time or location.

Additionally, the UPI system remains unaffected by holidays and unconventional hours, even during bank strikes. Users can swiftly register and execute immediate fund transfers. Consequently, these factors are anticipated to fuel the advancement of the UPI market in India throughout the forecast period

A notable trend in the evolving UPI market in India is the increasing prevalence of mobile apps for online shopping. The use of mobile apps for online shopping surpasses that of websites, primarily due to the rising prevalence of smart devices in the market. Market players like Google LLC, Paytm Payments Bank Limited, and Walmart Inc. contribute to this trend by providing UPI apps specifically designed for mobile use.

Observer Research Foundation (ORF):

As per another study made by a market research firm, the Observer Research Foundation (ORF), India’s UPI market size growth projections under various GDP scenarios are as follows:

- In the fiscal year 2030–31, UPI transactions are projected to amount to INR 542.7 trillion with a real GDP growth rate of 5%, considered below average. If the real GDP growth rate reaches the estimated average of 6.3%, the UPI transaction value is expected to be INR 600.7 trillion. These calculations are based on the baseline year of 2021–22.

- In the scenario where India attains a USD 5 trillion GDP milestone in 2025–26, 2026–27, and 2027–28, the corresponding sizes of the UPI market are forecasted to be INR 242.7 trillion, INR 280.3 trillion, and INR 356.3 trillion, respectively.

- Factors such as financial inclusion, the adoption of network infrastructure, and income levels are identified as positive and statistically significant contributors to UPI payments. While an increase in income has propelled digital transactions, developmental factors like digital literacy and digital inclusion have not exhibited a statistically significant impact on the size of digital payment markets.

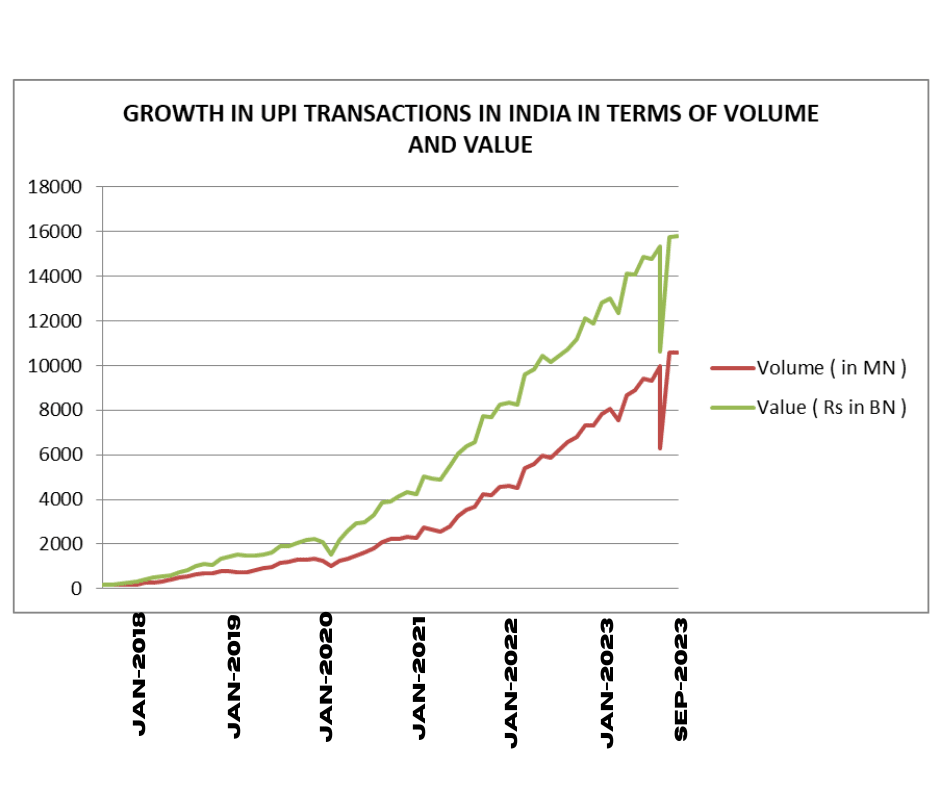

| GROWTH IN UPI TRANSACTIONS IN TERMS OF VOLUME AND VALUE | |||

| Month | No. of Banks Live on UPI | Volume ( in Million ) | Value (Rs in Billion ) |

| Sep-23 | 492 | 10556 | 15791 |

| Aug-23 | 484 | 10586 | 15765 |

| Jul-23 | 473 | 9965 | 15336 |

| Jun-23 | 458 | 9335 | 14755 |

| May-23 | 445 | 9415 | 14891 |

| Apr-23 | 414 | 8898 | 14070 |

| Mar-23 | 399 | 8685 | 14104 |

| Feb-23 | 390 | 7535 | 12358 |

| Jan-23 | 385 | 8037 | 12987 |

| Dec-22 | 382 | 7829 | 12820 |

| Nov-22 | 376 | 7309 | 11905 |

| Oct-22 | 365 | 7305 | 12116 |

| Sep-22 | 358 | 6781 | 11164 |

| Aug-22 | 346 | 6580 | 10728 |

| Jul-23 | 338 | 6288 | 10630 |

| Jun-22 | 330 | 5863 | 10144 |

| May-22 | 323 | 5955 | 10415 |

| Apr-22 | 316 | 5583 | 9833 |

| Mar-22 | 314 | 5406 | 9606 |

| Feb-22 | 304 | 4527 | 8268 |

| Jan-22 | 297 | 4617 | 8320 |

| Dec-21 | 282 | 4566 | 8268 |

| Nov-21 | 274 | 4186 | 7684 |

| Oct-21 | 261 | 4219 | 7714 |

| Sep-21 | 259 | 3654 | 6544 |

| Aug-21 | 249 | 3556 | 6391 |

| Jul-21 | 235 | 3248 | 6063 |

| Jun-21 | 229 | 2808 | 5474 |

| May-21 | 224 | 2540 | 4906 |

| Apr-21 | 220 | 2641 | 4937 |

| Mar-21 | 216 | 2732 | 5049 |

| Feb-21 | 213 | 2293 | 4251 |

| Jan-21 | 207 | 2303 | 4312 |

| Dec-20 | 207 | 2234 | 4162 |

| Nov-20 | 200 | 2210 | 3910 |

| Oct-20 | 189 | 2072 | 3861 |

| Sep-20 | 174 | 1800 | 3290 |

| Aug-20 | 168 | 1619 | 2983 |

| Jul-20 | 164 | 1497 | 2905 |

| Jun-20 | 155 | 1337 | 2618 |

| May-20 | 155 | 1235 | 2184 |

| Apr-20 | 153 | 1000 | 1511 |

| Mar-20 | 148 | 1247 | 2065 |

| Feb-20 | 146 | 1326 | 2225 |

| Jan-20 | 144 | 1305 | 2162 |

| Dec-19 | 143 | 1308 | 2025 |

| Nov-19 | 143 | 1219 | 1892 |

| Oct-19 | 141 | 1148 | 1914 |

| Sep-19 | 141 | 955 | 1615 |

| Aug-19 | 141 | 918 | 1545 |

| Jul-19 | 143 | 822 | 1464 |

| Jun-19 | 142 | 755 | 1466 |

| May-19 | 143 | 734 | 1524 |

| Apr-19 | 144 | 782 | 1420 |

| Mar-19 | 142 | 800 | 1335 |

| Feb-19 | 139 | 674 | 1067 |

| Jan-19 | 134 | 673 | 1099 |

| Dec-18 | 129 | 620 | 1026 |

| Nov-18 | 128 | 525 | 822 |

| Oct-18 | 128 | 482 | 750 |

| Sep-18 | 122 | 406 | 598 |

| Aug-18 | 114 | 312 | 542 |

| Jul-18 | 114 | 274 | 518 |

| Jun-18 | 110 | 246 | 408 |

| May-18 | 101 | 189 | 333 |

| Apr-18 | 97 | 190 | 270 |

| Mar-18 | 91 | 178 | 242 |

| Feb-18 | 86 | 171 | 191 |

| Jan-18 | 71 | 152 | 156 |

Key Challenges

While UPI transactions have experienced significant growth in India, several challenges may affect their continued expansion:

Cybersecurity Concerns:

With the increasing reliance on digital transactions, the risk of cyber security threats and fraud is a major concern. Ensuring the security of UPI transactions is crucial to maintaining user trust.

Digital Literacy:

A substantial portion of the population, especially in rural areas, lacks the necessary digital literacy skills to use UPI effectively. Promoting digital education and awareness is essential for broader adoption.

Infrastructure Limitations:

In some regions, there is inadequate digital infrastructure, including internet connectivity and smartphone access. Expanding and improving infrastructure is vital for enabling a broader user base.

Transaction Failures and Technical Glitches:

Users may face issues such as transaction failures, technical glitches, or downtime of UPI platforms. Improving the robustness and reliability of UPI systems is crucial to maintaining user confidence.

Regulatory Challenge

Evolving regulations and compliance requirements can pose challenges for UPI service providers. Adapting to regulatory changes while maintaining user-friendly services requires strategic planning.

Inclusive Access:

Ensuring inclusive access to UPI services for all socioeconomic groups, including those without smartphones or internet access, is a challenge. Solutions such as USSD (Unstructured Supplementary Service Data) can be explored to reach a wider audience.

Customer Support and Grievance Redressal:

Providing efficient customer support and a reliable grievance redressal system is crucial. Promptly addressing user concerns and issues contributes to overall satisfaction and trust in UPI services.

Competition from Alternative Payment Methods:

While UPI is widely adopted, competition from other payment methods, both digital and traditional, remains. Staying innovative and offering added value can help UPI maintain its competitive edge.

Addressing these challenges requires collaborative efforts from government bodies, financial institutions, technology providers, and the public. Continuous innovation, education, and infrastructure improvements are key to overcoming these obstacles on the road to sustained growth in UPI transactions in India.

UPI on the International Stage

The Unified Payments Interface (UPI), the revolutionary digital payment system that transformed the landscape of financial transactions in India, is gradually making its mark on the international stage. Initially designed to facilitate seamless and instant peer-to-peer payments within India, UPI’s success has garnered attention from various countries seeking to enhance their digital payment ecosystems

These global collaborations have materialized as NIPL (NPCI International Payments Limited) actively forges partnerships with various countries, aiming to establish an extensive acceptance network for RuPay and UPI. This initiative is designed to empower Indian travelers, enabling them to conduct transactions through these platforms in their respective destination countries. Established in April 2020, NIPL operates as a wholly owned subsidiary of the National Payments Corporation of India (NPCI), with a dedicated focus on deploying RuPay and UPI beyond India.

Additionally, aligning with its aspirations for digital economic expansion, India has introduced UPI access for Non-Resident Indians (NRIs) in ten foreign countries. This access is granted to NRIs whose Indian bank accounts are linked to foreign mobile numbers. Furthermore, foreign travelers visiting India will also benefit from this service, particularly at select international airports, showcasing India’s commitment to facilitating seamless digital transactions for a global audience.

The following is the list of countries where the Unified Payment Interface (UPI) has been adopted and accepted:

| Country | Organization Collaborating with UPI Network |

| Singapore | Monetary Authority of Singapore, PayNow |

| Malaysia | Merchantrade Asia |

| Bhutan | Royal Monetary Authority of Bhutan |

| Singapore, Malaysia, Thailand, Philippines, Vietnam, Cambodia, Hong Kong, Taiwan, South Korea, Japan | Liquid Group |

| United Arab Emirate | Network International Lulu Financial, NEOPAY (Mashreq Bank) UAE Central Bank’s Instant Payment Platform (IPP) |

| Nepal | Gateway Payment Services, Manam Infotech |

| France | Lyra |

| United Kingdom | Terrapay PayXpert |

| Netherland, Belgium, Luxemburg, Switzerland | Worldline |

| Oman | Central Bank of Oman |

| Sri Lanka | Network-to-network aggrement for UPI acceptance |

UPI One World

Designed specifically for inbound travelers, UPI One World offers a tailored glimpse into the UPI experience. This prepaid payment instrument, linked to UPI, is provided to foreign nationals and non-resident Indians (NRIs) arriving from G20 countries.

The Prepaid Payment Instrument (PPI) on the UPI wallet enables seamless transactions at merchants nationwide. “UPI One World” is now available for issuance to foreign nationals and NRIs from G20 countries, requiring only a passport and a valid visa as documentation. Upon completion of the KYC process, foreign nationals and NRIs will be issued UPI One World.

Loading funds onto UPI One World can be done through the receipt of foreign exchange, either in cash or through various payment instruments. Subsequently, UPI One World facilitates payments and service transactions at all UPI-enabled merchant locations.”

UPI Circle

The integration of UPI across various mobile applications is what makes this payment method preferred by millions. Nevertheless its widespread use, there are some who still heavily depend on it for their daily transactions because their financial management is entrusted to someone else- more so with those mandated that all accounts shall be held jointly. NPCI had conceptualized the marriage around this as UPI Circle which has to some extent bridged the gap between corporate debit card acceptance and using a P2P app. The initiative allows UPI users to delegate the payment mandate and make it available even for secondary parties at scale, a unique use-case of digital payments.

The UPI Circle is a huge development in the history of such which helps users who need to depend on someone else for financial management. Through this kind of digital payment service, NPCI is making the ecosystem more democratic for users by letting primary users delegate their payment rights to secondary points. The platform provides increased security, a unique set of rules, and real-time transaction insights to both the originator on behalf of UPI as the so-called “UPI Circle,” all with strong compliance features, making it easier for genuine users in doing their transactions while maintaining protected/controlled payment experience.

While UPI keeps growing by leaps and bounds in its scope, services like ‘UPI Circle’ are a testament to NPCI’s innovation-driven alliances that bring about change across layers of India.

What is “UPI Circle”?

UPI Circle is built on top of the UPI framework that will enable a primary user to designate his trusted known contacts as secondary users and delegate the right-to-send money (payment) using this capability. The delegation could be either partial or full and depends on how much or little the main user wants to have control over it.

Full Delegation: In Direct mode, the primary user delegates his full permissions to authorize all UPI transactions by the secondary user On the other hand, with this delegation feature, the primary user can set up specific spending limits for these transactions to maintain control and track their money flow.

Partial Delegation: Things are otherwise in the case of partial delegation where the secondary user can only initiate payment requests. The transaction can be completed by placing the UPI PIN of only the primary user hence an added layer of security.

Linking Process: A secondary user can be linked by the primary user by scanning a QR code or asking for a UPI ID, choosing a contact number in their phone book. To make this easy, NPCI is looking to allow linking playing of WhatsApp with contact number selection only. Any unauthorized access will be foreclosed due to the deployment of manual mobile number input.

Delegation Limits: Every primary user can delegate payment control to 5 secondary users. On the other hand, a secondary user can only accept delegation from one primary user maintaining an orderly and easy-to-manage state of delegating.

Usage Limit Controls: Tailor-made payment experience – Primary users can set and manage transfer limits for secondary users.

NPCI has set up a maximum monthly transaction cap of ₹15,000 per delegation and each transaction’s limit is capped at ₹5,000 for full delegation. While for partial delegation, the current UPI transaction limits will remain in force.

Cooling Period: Following approval of the primary-secondary user pairing, a cooling-off period is enforced during the first 24 hours. Full and partial delegations will be limited to ₹5,000 per day during this phase

Transaction Visibility: The primary user will have complete insight into transactions that its secondary users perform. This visibility will appear on their UPI App and bank account statements, facilitating proper tracking of delegated transactions.