Introduction

The NASDAQ Composite Index is a widely followed benchmark index that reflects the performance of a broad range of stocks listed on the NASDAQ Stock Market. It is a key indicator of the health and trends within the technology and growth-oriented sectors of the stock market. The NASDAQ Composite Index plays a significant role in the financial industry, serving as a barometer for investors, analysts, and market participants to gauge the overall performance of technology-driven companies.

Construction and Composition of the Index

The NASDAQ Composite Index is constructed to represent the performance of a diverse array of stocks listed on the NASDAQ Stock Market. It includes companies from various sectors, with a particular emphasis on technology and growth-oriented industries. Here are the key aspects of the index’s construction and composition:

Inclusion Criteria:

- To be eligible for inclusion in the index, a company must be listed on the NASDAQ Stock Market and meet the exchange’s listing requirements and regulations.

- The company should have a minimum market capitalization threshold to be considered for inclusion in the index. This criterion ensures that the index represents significant and established companies.

Market Capitalization Weighting:

- The NASDAQ Composite Index uses a market capitalization weighting methodology, which means that the weight of each component is determined based on its market value. Larger companies with higher market capitalizations have a more significant impact on the index’s performance.

- Market capitalization is calculated by multiplying a company’s stock price by the number of outstanding shares. This methodology ensures that the index accurately reflects the performance of the constituent companies in proportion to their market values.

Sectors and Industries:

- The NASDAQ Composite Index covers a broad range of sectors and industries. While technology companies form a significant portion of the index, it also includes companies from sectors such as consumer discretionary, healthcare, industrials, communications, and more.

- The index aims to provide a comprehensive representation of the entire NASDAQ Stock Market, reflecting the diversity of the companies listed on the exchange.

Rebalancing and Reconstitution:

- The NASDAQ Composite Index undergoes periodic rebalancing and reconstitution to maintain its representation of the market. The index is reviewed regularly, and changes are made to ensure that it accurately reflects the current market conditions and the performance of the listed companies.

- Rebalancing involves adjusting the weights of the index constituents based on their market capitalizations. As companies’ market values change, their impact on the index is adjusted to maintain the index’s overall integrity.

Global Representation:

- The NASDAQ Composite Index includes both domestic and international companies listed on the NASDAQ Stock Market. This global representation provides investors with exposure to a diverse set of companies from various countries and regions.

- The inclusion of international companies also reflects the NASDAQ’s standing as a global exchange and highlights its attractiveness to companies seeking international listings.

Key Features and Characteristics: NASDAQ Composite Index

The NASDAQ Composite Index possesses several key features and characteristics that distinguish it as a benchmark index for the technology and growth-oriented sectors. These features contribute to its significance and attractiveness to investors and market participants. Let’s explore some of the key features and characteristics of the NASDAQ Composite Index:

- The NASDAQ Composite Index is renowned for its strong emphasis on technology and growth-oriented companies. It includes a significant number of leading technology giants such as Apple, Microsoft, Amazon, Google, and Facebook, among others.

- The index’s focus on technology reflects the NASDAQ’s historical association with technology companies and its role as a hub for innovation and technological advancements. As a result, it has become a reliable indicator of the performance of the technology sector and related growth industries.

- The NASDAQ Composite Index provides a broad-based representation of the stock market. It includes companies from various sectors, not limited to technology. This diversified composition ensures that the index captures the performance of a wide range of industries, including consumer discretionary, healthcare, industrials, communications, and more.

- The index’s broad representation makes it a comprehensive barometer of the overall stock market, providing insights into the performance of both technology-focused companies and other sectors.

- The NASDAQ Composite Index covers a spectrum of market capitalizations, ranging from large-cap to small-cap stocks. This inclusion of companies across different market capitalization tiers offers a holistic view of the market, encompassing both established industry leaders and emerging growth companies.

- The presence of smaller-cap companies in the index highlights the NASDAQ’s role in fostering entrepreneurship and providing a platform for emerging businesses to gain visibility and access to capital.

- The NASDAQ Composite Index has a global reach, encompassing companies from various countries and regions. It includes international companies listed on the NASDAQ Stock Market, reflecting the exchange’s global standing and its attractiveness to companies seeking a presence in the international market.

- The index’s global representation provides investors with exposure to a diverse set of companies and allows them to track the performance of both domestic and international markets within the technology and growth sectors.

- Due to its focus on technology and growth-oriented companies, the NASDAQ Composite Index has historically exhibited strong growth performance compared to other benchmark indices. This growth potential makes it appealing to investors seeking exposure to companies with high growth prospects.

- The index’s performance is influenced by the dynamic nature of the technology sector and its ability to drive innovation, disrupt traditional industries, and create new markets. Consequently, the NASDAQ Composite Index is often seen as an indicator of the overall market sentiment toward growth-oriented investments.

Methodology and Calculation

The NASDAQ Composite Index is calculated using a methodology that takes into account the market capitalizations and stock prices of the constituent companies. Here’s an explanation of the index calculation methodology, along with examples to illustrate the process:

Market Capitalization Weighting:

- The NASDAQ Composite Index utilizes a market capitalization weighting methodology. This means that the weight of each component in the index is determined by its market value, which is calculated by multiplying the stock price by the number of outstanding shares.

- The market capitalization of each company is compared to the total market capitalization of all the companies included in the index. The proportionate weight of a particular company is determined by dividing its market capitalization by the sum of the market capitalizations of all the index components.

For example:

Let’s consider a hypothetical NASDAQ Composite Index with three companies:

Company A has a market capitalization of $50 billion.

Company B has a market capitalization of $100 billion.

Company C has a market capitalization of $150 billion.

The total market capitalization of these three companies is $300 billion. To calculate the weight of each company in the index:

Company A weight: $50 billion / $300 billion = 16.67%

Company B weight: $100 billion / $300 billion = 33.33%

Company C weight: $150 billion / $300 billion = 50%

The weights determine the influence of each company on the index’s overall performance. Larger companies with higher market capitalizations will have a greater impact on the index’s movements.

Adjustments for Stock Splits, Dividends, and Corporate Actions :

- The NASDAQ Composite Index takes into account corporate actions such as stock splits, dividends, and other adjustments that may affect the stock prices or market capitalizations of the constituent companies.

- When a company undergoes a stock split, for example, the number of shares outstanding increases, but the overall market capitalization remains the same. In such cases, the index’s methodology ensures that the stock split does not disproportionately affect the weight of the company in the index.

- Dividends and other corporate actions that may impact stock prices or market capitalizations are also considered when calculating the index.

Rebalancing and Reconstitution:

The NASDAQ Composite Index undergoes periodic rebalancing and reconstitution to maintain its representation of the market. This process involves reviewing the index components and making necessary adjustments to ensure that the index accurately reflects the current market conditions and the performance of the listed companies.

Rebalancing involves adjusting the weights of the index constituents based on their market capitalizations. As companies’ market values change over time, their impact on the index is adjusted to maintain the index’s overall integrity.

Example:

Let’s consider a simplified example of the NASDAQ Composite Index with three hypothetical companies and their respective market capitalizations and stock prices:

Company X: Market capitalization = $80 billion, Stock price = $200

Company Y: Market capitalization = $120 billion, Stock price = $60

Company Z: Market capitalization = $200 billion, Stock price = $400

To calculate the index value, we first determine the weight of each company based on its market capitalization:

Company X weight: $80 billion / ($80 billion + $120 billion + $200 billion) = 0.2 or 20%

Company Y weight: $120 billion / ($80 billion + $120 billion + $200 billion) = 0.3 or 30%

Company Z weight: $200 billion / ($80 billion + $120 billion + $200 billion) = 0.5 or 50%

Next, we multiply each company’s weight by its stock price and sum the results:

($200 x 0.2) + ($60 x 0.3) + ($400 x 0.5) = $40 + $18 + $200 = $258

The resulting value of $258 represents the index value, indicating the performance of the NASDAQ Composite Index based on the weighted average of the three companies.

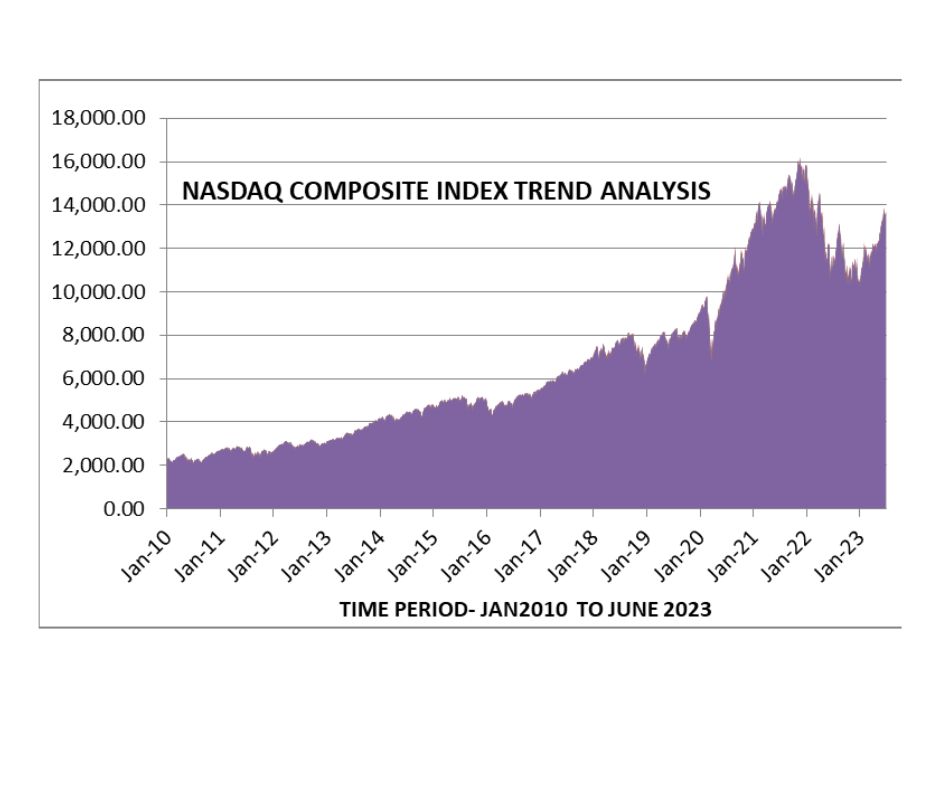

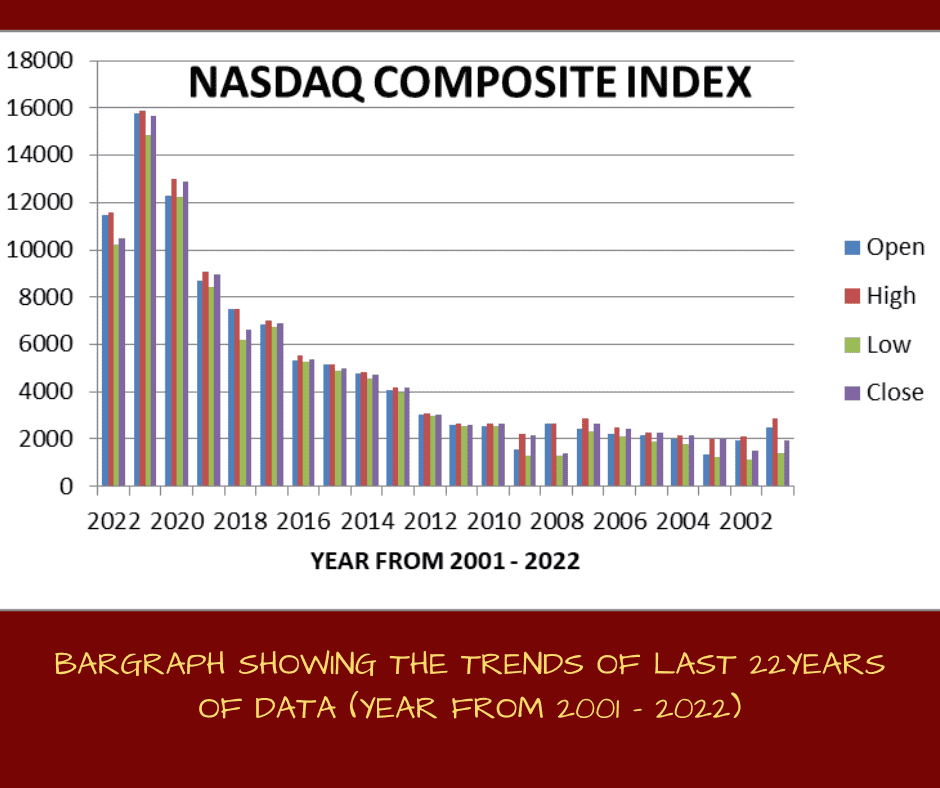

Performance and Historical Trends

The performance of the NASDAQ Composite Index has been noteworthy, particularly concerning its focus on technology and growth-oriented companies. Over the years, the index has experienced significant growth and has witnessed both periods of remarkable gains and periods of volatility.

- The NASDAQ Composite Index has demonstrated impressive long-term growth. It has outperformed many other major stock market indices, driven by the success and expansion of the technology sector. The index’s focus on innovative companies with high growth potential has contributed to its remarkable performance.

- For instance, during the dot-com boom of the late 1990s, the NASDAQ Composite Index experienced an extraordinary surge, fueled by the rapid growth of internet-based companies. However, it also experienced a significant decline during the subsequent dot-com bubble burst in the early 2000s.

- As a key benchmark for technology companies, the NASDAQ Composite Index is particularly sensitive to developments within the technology sector. The performance of major technology giants, such as Apple, Microsoft, Amazon, and Google, significantly influences the index’s movements.

- Technological advancements, product launches, and shifts in consumer preferences within the technology sector can have a substantial impact on the index’s performance. Strong performance by tech companies often leads to positive movements in the index.

- The NASDAQ Composite Index is known for its potential volatility, primarily due to the nature of the technology and growth-oriented companies it represents. These companies often experience rapid growth but can also be more susceptible to market fluctuations.

- The index has been affected by significant market events, such as the bursting of the dot-com bubble in the early 2000s and the global financial crisis of 2008. During these periods, the index experienced substantial declines but eventually recovered and continued its upward trajectory.

- Mega-cap companies, particularly those in the technology sector, exert a significant influence on the performance of the NASDAQ Composite Index. These large, established companies with substantial market capitalizations can heavily impact the index’s movements.

- The performance of mega-cap companies can overshadow the performance of smaller companies within the index. As a result, changes in the stock prices and market capitalizations of these influential companies have a more substantial effect on the index as a whole.

- In recent years, the NASDAQ Composite Index has experienced strong growth, fueled by the increasing dominance of technology companies and the accelerated adoption of digital technologies in various industries. The COVID-19 pandemic further accelerated the digital transformation and contributed to the index’s resilience and growth.

- However, it is important to note that the index’s performance is subject to market conditions, investor sentiment, economic factors, and geopolitical events. It is essential to assess the broader market landscape and not rely solely on past performance when making investment decisions.

Significance and Implications

For investors, analysts, and market participants, the NASDAQ Composite Index is extremely important and has huge ramifications. In addition to its past achievements, its emphasis on technology and growth-driven companies has multiple ramifications.

- The NASDAQ Composite Index serves as a crucial barometer for the performance of the technology sector. As the index includes a substantial number of technology companies, it provides insights into the overall health and trends within the technology industry.

- Investors and analysts often use the index as a reference point to evaluate the performance and prospects of technology companies, assess market sentiment towards the sector, and make informed investment decisions.

- The index’s emphasis on growth-oriented companies reflects its role as an indicator of innovation and future growth prospects. The performance of the NASDAQ Composite Index is closely tied to the success of companies that drive technological advancements and disrupt traditional industries.

- It serves as a gauge of market sentiment towards high-growth sectors and acts as a reference for investors seeking exposure to companies with significant growth potential.

- The performance of the NASDAQ Composite Index can impact investor sentiment and confidence. Positive movements in the index often signal optimism and encourage investors to allocate capital to technology and growth-oriented investments.

- Conversely, significant declines or periods of volatility within the index can erode investor confidence and lead to cautious market sentiment, particularly within the technology sector.

- The NASDAQ Composite Index serves as a benchmark for technology-focused and growth-oriented funds. Fund managers and investors use the index’s performance as a comparison tool to evaluate the returns of their portfolios and assess the effectiveness of their investment strategies.

- Many mutual funds, exchange-traded funds (ETFs), and other investment vehicles are designed to track or replicate the performance of the NASDAQ Composite Index, providing investors with opportunities to gain exposure to a diversified portfolio of technology and growth companies.

- The NASDAQ Composite Index’s global reach and representation highlight its relevance in the global financial landscape. Its inclusion of international companies listed on the NASDAQ Stock Market makes it attractive to investors seeking exposure to global technology and growth sectors.

- The index’s performance can influence global market sentiment and serve as a reference point for international investors assessing the health and trends within the technology industry.

- The performance of the NASDAQ Composite Index can provide insights into the broader economy. As technology and growth-oriented companies contribute significantly to economic growth and job creation, positive movements in the index can signal overall economic strength.

- Additionally, the index’s performance during periods of economic downturns or recessions can offer indications of the resilience and recovery potential of the technology and growth sectors.

Notable Components and Influential Companies: NASDAQ Composite Index

The NASDAQ Composite Index includes a diverse array of companies from various sectors, with a strong focus on technology and growth-oriented industries.

Apple Inc. (AAPL):

- Apple is one of the most influential companies in the world and a leading component of the NASDAQ Composite Index. It designs, manufactures, and sells consumer electronics, software, and digital services.

- As a pioneer in the technology industry, Apple’s products, such as the iPhone, iPad, Mac, and various software applications, have revolutionized the way people communicate and access information.

Microsoft Corporation (MSFT):

- Microsoft is a global technology giant known for its software products, including the Windows operating system, Office productivity suite, and cloud computing services through Microsoft Azure.

- With its strong presence in both consumer and enterprise markets, Microsoft plays a pivotal role in the technology sector’s growth and is a key constituent of the NASDAQ Composite Index.

Amazon.com Inc. (AMZN):

- Amazon is a dominant force in the e-commerce industry and a significant player in cloud computing through Amazon Web Services (AWS).

- Its vast product offerings, extensive global reach, and innovative services have positioned Amazon as a top performer in the index.

Alphabet Inc. (GOOGL, GOOG):

- Alphabet is the parent company of Google, the world’s leading search engine and digital advertising platform.

- Its presence in internet search, online advertising, cloud services, and other technology-driven ventures solidifies Alphabet’s place as a major component of the NASDAQ Composite Index.

Facebook Inc. (FB):

- Facebook is a social media giant that owns several popular platforms, including Facebook, Instagram, WhatsApp, and Oculus VR.

- Its widespread global user base and dominance in social media make Facebook a highly influential company within the index.

Tesla Inc. (TSLA):

- Tesla is a pioneering electric vehicle manufacturer and clean energy company. It has revolutionized the automotive industry with its electric cars and renewable energy solutions.

- Tesla’s rapid growth and innovative technology have propelled it to a prominent position within the NASDAQ Composite Index.

NVIDIA Corporation (NVDA):

- NVIDIA is a leading manufacturer of graphics processing units (GPUs) and artificial intelligence (AI) computing solutions.

- Its GPUs are widely used in gaming, data centers, AI applications, and autonomous vehicles, contributing to its significance within the technology sector and the index.

Netflix Inc. (NFLX):

- Netflix is a prominent provider of streaming entertainment services, offering a vast library of movies, TV shows, and original content.

- As a pioneer in the streaming industry, Netflix’s influence in the media and entertainment sectors makes it a noteworthy component of the NASDAQ Composite Index.

Adobe Inc. (ADBE):

- Adobe is a software company known for its creative and multimedia software products, including Photoshop, Illustrator, and Adobe Creative Cloud.

- Its software solutions are widely used by creative professionals, businesses, and individuals, solidifying Adobe’s position within the technology sector.

PayPal Holdings Inc. (PYPL):

- PayPal is a leading digital payments platform, enabling secure online transactions and payment processing services.

- Its role in the growing digital payments industry contributes to its influence within the NASDAQ Composite Index.

These notable components and influential companies within the NASDAQ Composite Index showcase the diversity and significance of the technology and growth-oriented sectors. Their innovations, market dominance, and financial performance contribute to the index’s reputation as a vital barometer for the technology industry and the broader market.

Limitations and Criticisms: NASDAQ Composite Index

Sector Bias:

- The NASDAQ Composite Index exhibits a significant bias toward the technology sector. While this can be advantageous during periods of strong growth in the technology industry, it also leaves the index vulnerable to downturns or market corrections within the sector.

- The heavy concentration of technology companies in the index may not accurately represent the overall performance of the broader market or other sectors.

Limited Representation:

- The NASDAQ Composite Index focuses primarily on companies listed on the NASDAQ Stock Market. This exclusion of companies listed on other exchanges, such as the New York Stock Exchange (NYSE), may result in a limited representation of the overall market and fail to capture the performance of significant players in industries not predominantly represented on NASDAQ.

Market Capitalization Weighting:

- While market capitalization weighting is a commonly used methodology, it has its limitations. This approach can lead to an overemphasis on larger companies with higher market capitalizations, potentially skewing the index’s performance towards a small number of influential constituents.

- The index may not fully capture the performance of smaller, yet promising, companies that could potentially have a substantial impact on the overall market.

Volatility and Tech-Driven Fluctuations:

- The NASDAQ Composite Index is known for its potential volatility due to the nature of the technology and growth-oriented companies it comprises. This volatility can make the index more susceptible to sharp fluctuations, especially during periods of market turbulence or sector-specific events.

- Investors should be cautious when interpreting short-term movements in the index, as they may not necessarily reflect the broader market sentiment or economic conditions.

Historical Bias:

- The NASDAQ Composite Index has a historical bias towards technology companies, particularly during the dot-com boom and subsequent bubble burst in the late 1990s and early 2000s. This historical context can influence the perception of the index’s long-term performance and potential biases in its constituent selection.

Lack of Dividend Emphasis:

- The NASDAQ Composite Index does not place a significant emphasis on dividends. As a result, it may not fully capture the performance of companies that prioritize dividend payments and may undervalue income-generating stocks.

- Investors seeking exposure to dividend-focused or income-oriented strategies may need to consider other indices that better align with their investment objectives.

Influence of Large-Cap Companies:

- The influence of large-cap technology companies, such as Apple, Microsoft, Amazon, and Google, on the index’s performance can be both an advantage and a limitation. While their strong performance can positively impact the index, a downturn in these influential companies can have a disproportionate effect on the overall index movement.

Final Takeaway

The NASDAQ Composite Index is a widely recognized and influential benchmark that reflects the performance of technology and growth-oriented companies listed on the NASDAQ Stock Market. With its focus on innovation, disruptive technologies, and high-growth potential, the index provides valuable insights into the health and trends within the technology sector.

Throughout its history, the NASDAQ Composite Index has demonstrated impressive long-term growth, outperforming many other major stock market indices. However, it is important to consider the limitations and criticisms associated with the index, such as its sector bias, limited representation, and market capitalization weighting.

Understanding the methodology, performance, historical trends, and limitations of the NASDAQ Composite Index is crucial for investors seeking exposure to the technology and growth sectors. It provides a valuable tool for assessing market conditions, making informed investment decisions, and gaining insights into the ever-evolving landscape of the global financial markets.