From Bull to Bear: Understanding S&P 500 Index’s Performance

Introduction

The S&P 500 index is a renowned benchmark that represents the performance of the largest and most influential companies in the United States stock market. It serves as a key indicator of the overall health and trends within the U.S. economy. As one of the most widely followed and referenced stock market indices, the S&P 500 holds significant importance for investors, financial professionals, and market participants.

History and Background

The history of the S&P 500 index dates back to the early 20th century, when the need arose for a comprehensive measure of the U.S. stock market’s performance.

- The S&P 500 index was introduced in 1957 by Standard & Poor’s Financial Services LLC (S&P). It was designed as a successor to the S&P 90 index, which consisted of 90 large-cap stocks.

- The original purpose of the index was to provide a representative snapshot of the U.S. equity market by including a broader selection of stocks.

- Over the years, the S&P 500 index has undergone several expansions and modifications to improve its representation and accuracy.

- In 1988, the index expanded to include 400 stocks, and in 1994, it reached its current composition of 500 stocks.

- The methodology for selecting index constituents has also evolved, with an emphasis on market capitalization and liquidity as key criteria.

- In 1999, the Global Industry Classification Standard (GICS) was introduced to categorize companies into specific industry sectors. This classification system provided a standardized framework for sector representation within the S&P 500 index.

- Today, the index includes companies from various sectors, including technology, healthcare, financials, consumer discretionary, industrials, and more.

- The S&P 500 index has witnessed significant volatility and fluctuations throughout its history, particularly during periods of financial crises.

- Notable events include the Black Monday crash in 1987, the dot-com bubble burst in the early 2000s, and the global financial crisis of 2008.

- Despite these downturns, the index has demonstrated resilience and the ability to recover and reach new highs in subsequent years.

- The rise of technology and the digital era have significantly influenced the composition and performance of the S&P 500 index.

- Companies such as Apple, Microsoft, Amazon, Google, and Facebook have emerged as influential components, driving the index’s growth and reflecting the dominance of the technology sector.

- Standard & Poor’s Financial Services LLC (S&P) is responsible for maintaining and calculating the S&P 500 index. The index is widely recognized and used by investors, fund managers, and financial professionals around the world.

- S&P licenses the index to financial institutions and exchange-traded funds (ETFs) for the creation of investment products that track its performance.

Composition and Selection: S&P 500 Index

The S&P 500 index is composed of 500 large-cap U.S. companies, representing a broad cross-section of industries and sectors. The selection process involves specific criteria to ensure the index accurately reflects the performance of the U.S. stock market.

Inclusion Criteria:

- Companies included in the index must have a market capitalization that ranks among the largest in the U.S. stock market.

- Eligible companies must be listed on either the New York Stock Exchange (NYSE) or the NASDAQ Stock Market, and meet specific liquidity requirements.

- Companies must have had positive earnings over the most recent four quarters, as determined by generally accepted accounting principles (GAAP).

Sector Classification:

- The Global Industry Classification Standard (GICS) is used to categorize companies into sectors and industries.

- S&P ensures that each sector is well-represented within the index, reflecting the overall composition of the U.S. economy.

Market Capitalization Weighting:

- The S&P 500 index utilizes a market capitalization weighting methodology. Market capitalization is calculated by multiplying a company’s share price by its total number of outstanding shares.

- The weight of each constituent within the index is determined by its market capitalization relative to the total market capitalization of all the companies in the index.

- This approach gives larger companies a higher weighting, resulting in their greater influence on the index’s performance.

Index Rebalancing:

- The S&P 500 index is periodically rebalanced to ensure it remains representative of the U.S. stock market. Rebalancing typically occurs on a quarterly basis.

- During rebalancing, new companies may be added to the index if they meet the inclusion criteria, while others may be removed due to changes in market capitalization or financial performance.

- Rebalancing also involves adjusting the weights of existing constituents to reflect changes in their market capitalization.

Representation and Diversification:

- The S&P 500 index aims to provide diversification by including companies from various sectors and industries.

- The goal is to capture the performance of the broader U.S. economy and minimize the impact of individual company fluctuations on the overall index.

Large-Cap Influence:

- Large-cap companies, such as Apple, Microsoft, Amazon, Google, and Facebook, have a significant impact on the S&P 500 index due to their large market capitalizations.

- The performance of these influential companies can heavily influence the movements of the index as a whole.

Methodology and Calculation– S&P 500 Index

The S&P 500 index utilizes a transparent and well-defined methodology for its calculation. This methodology ensures that the index accurately reflects the performance of the included companies and provides a reliable benchmark for investors.

Weighting Methodology:

The S&P 500 index employs a market capitalization weighting methodology. This means that the weight of each constituent within the index is determined by its market capitalization relative to the total market capitalization of all the companies in the index.

Market capitalization is calculated by multiplying a company’s share price by its total number of outstanding shares. Larger companies with higher market capitalizations have a greater impact on the index’s performance.

Free Float Adjustment:

The index considers only the free float market capitalization of each company. Free float refers to the shares that are available for trading by the public and excludes shares held by insiders, promoters, or governments.

The use of free-float market capitalization helps ensure that the index accurately reflects the shares available for trading and avoids the influence of shares that are not freely tradable.

Calculation Process

The calculation of the S&P 500 index is straightforward and involves several steps:

- Determine the market capitalization of each constituent: Multiply the current share price of each company by the number of outstanding shares.

- Calculate the total market capitalization: Sum up the market capitalizations of all the companies in the index.

- Calculate the weight of each constituent: Divide the market capitalization of each company by the total market capitalization.

- Calculate the index level: Multiply the weight of each constituent by its corresponding share price, and sum up the results for all constituents.

- Apply a divisor: To ensure continuity and account for corporate actions, a divisor is used to adjust the index level. The divisor is adjusted periodically to account for changes in the index’s constituents and their market capitalizations.

Example Calculation:

Let’s consider a simplified example of the S&P 500 index calculation with three hypothetical companies:

Company A has a market capitalization of $100 billion.

Company B has a market capitalization of $50 billion.

Company C has a market capitalization of $75 billion.

Assuming the total market capitalization of all S&P 500 constituents is $1 trillion, the weight of each company would be calculated as follows:

Company A weight = $100 billion / $1 trillion = 0.10 or 10%

Company B weight = $50 billion / $1 trillion = 0.05 or 5%

Company C weight = $75 billion / $1 trillion = 0.075 or 7.5%

If the share prices of these companies were $200, $100, and $150, respectively, the index level would be calculated as follows:

Index level = (0.10 * $200) + (0.05 * $100) + (0.075 * $150) = $20 + $5 + $11.25 = $36.25

The methodology and calculation process of the S&P 500 index ensure that it accurately reflects the performance of its constituents and provides a reliable measure of the U.S. stock market. The market capitalization weighting methodology, combined with the use of free-float market capitalization, allows for the representation of larger companies while maintaining diversification.

Significance and Implications

The S&P 500 index holds significant importance and has far-reaching implications for investors, financial professionals, and the broader financial markets.

Benchmark for the US Stock Market:

- The S&P 500 index serves as a widely recognized benchmark for the performance of the U.S. stock market. It represents a broad cross-section of large-cap companies and provides a gauge of the overall health and trends within the market.

- Many investment funds and portfolios are measured against the S&P 500 index as a performance benchmark. It is used to evaluate the relative success or failure of investment strategies and portfolio managers.

Investor Sentiment and Market Trends:

- The movements and performance of the S&P 500 index reflect investor sentiment and market trends. A rising index often indicates optimism and bullish sentiment, while a declining index may signal pessimism and bearish sentiment.

- Investors and analysts closely monitor the S&P 500 index to gauge the direction of the overall market, make informed investment decisions, and identify potential investment opportunities.

Investment Strategies and Portfolio Management:

- The S&P 500 index plays a crucial role in shaping investment strategies and portfolio management. Many investors seek to replicate the index’s performance or outperform it through active management.

- Passive investment strategies, such as index funds and exchange-traded funds (ETFs), track the S&P 500 index to provide broad market exposure and low-cost diversification.

- Active portfolio managers use the S&P 500 index as a reference point to assess their performance and make allocation decisions.

Market Liquidity and Accessibility:

- The S&P 500 index represents highly liquid and widely traded stocks, ensuring that it is accessible to investors. It provides a liquid market for buying and selling shares of the index constituents.

- The liquidity of the S&P 500 index enhances the efficiency of the market, facilitates price discovery, and attracts global investors looking to gain exposure to the U.S. stock market.

Global Market Influence:

- The S&P 500 index’s performance has a significant impact on global markets and economies. As one of the most widely followed stock market indices, its movements can influence investor sentiment, capital flows, and economic indicators worldwide.

- Changes in the S&P 500 index can impact other stock indices, such as the Dow Jones Industrial Average and the NASDAQ Composite Index, as well as international stock markets.

Economic Indicator:

- The S&P 500 index is often used as a proxy for the overall health of the U.S. economy. Its performance is closely watched as an economic indicator, and changes in the index can provide insights into economic growth or contraction.

- Due to the index’s composition of large-cap companies representing various sectors, it can be seen as a gauge of corporate profitability, investment sentiment, and overall economic activity.

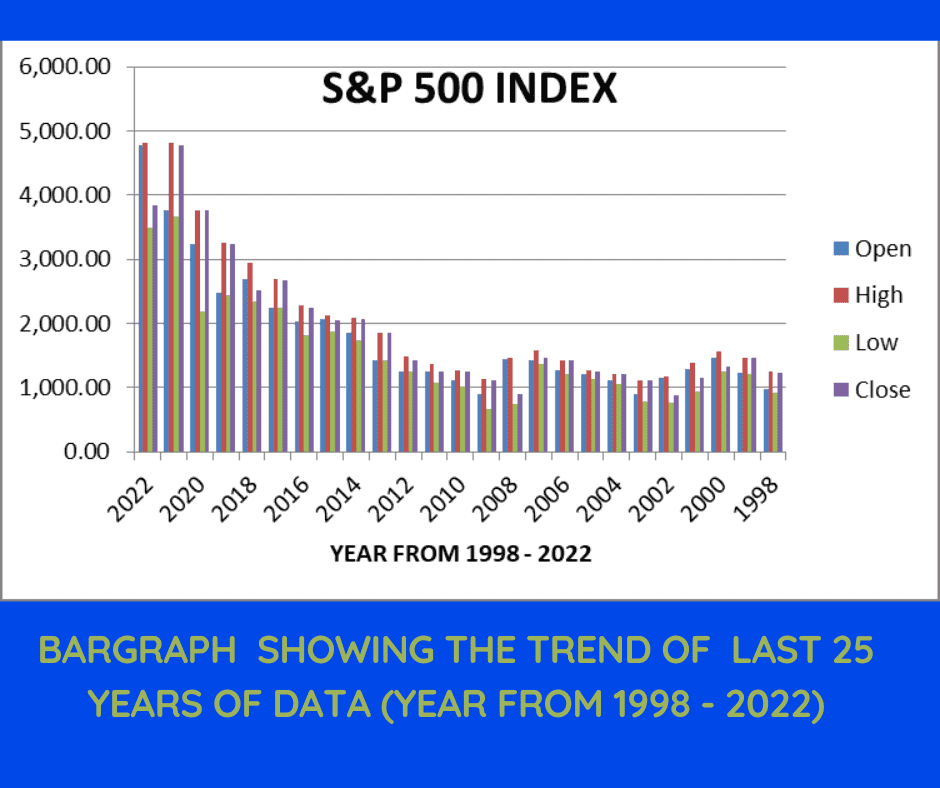

Performance and Historical Trends: S&P 500 Index

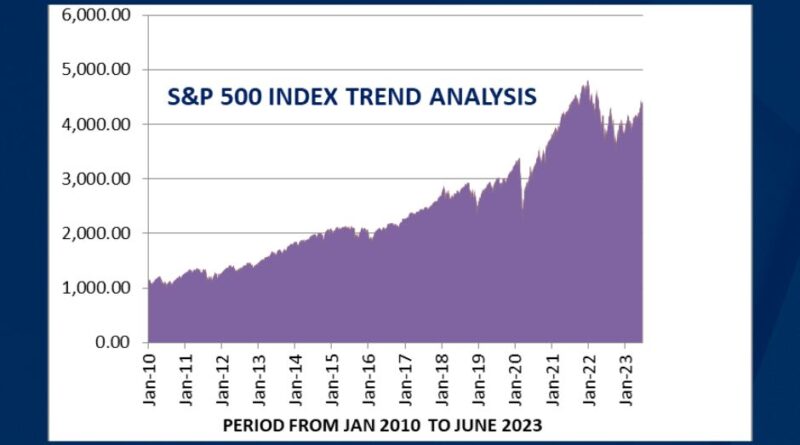

The performance of the S&P 500 index over time provides valuable insights into the historical trends and patterns of the U.S. stock market.

Long-Term Performance:

- The S&P 500 index has delivered solid long-term performance, reflecting the growth of the U.S. economy and corporate profitability.

- Over extended periods, the index has generally exhibited an upward trajectory, despite short-term market fluctuations and periodic downturns.

- Historical data reveals that the index has generated positive average annual returns, providing investors with the potential for long-term wealth accumulation.

Bull and Bear Markets:

- The S&P 500 index has experienced both bull and bear markets throughout its history.

- Bull markets refer to extended periods of rising stock prices and positive investor sentiment, while bear markets entail declining stock prices and negative sentiment.

- Bull markets are typically characterized by strong economic growth, low interest rates, and an optimistic investor outlook, leading to significant gains in the index.

- Bear markets, on the other hand, are associated with economic recessions, market downturns, and heightened market volatility, resulting in substantial index declines.

Major Events and Impact on Performance:

- Major events and crises have had a notable impact on the performance of the S&P 500 index.

- For example, the dot-com bubble burst in the early 2000s resulted in a significant decline in the index as technology stocks experienced a sharp correction.

- The global financial crisis of 2008, triggered by the subprime mortgage meltdown, led to a severe bear market and substantial losses in the index.

- However, the S&P 500 index has demonstrated resilience and the ability to recover from downturns, often reaching new highs in subsequent years.

Market Volatility and Short-Term Fluctuations:

- The S&P 500 index is subject to market volatility, which can lead to short-term fluctuations in its performance.

- Various factors contribute to market volatility, including economic indicators, geopolitical events, corporate earnings reports, and investor sentiment.

- Investors should be prepared for short-term market fluctuations and understand that the index’s performance can be influenced by a wide range of factors.

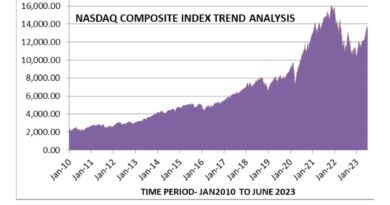

Index Performance Relative to Other Indices:

- Comparing the performance of the S&P 500 index with other major stock market indices can provide insights into regional and global market trends.

- The performance of the Dow Jones Industrial Average (DJIA), NASDAQ Composite Index, and international indices can offer additional perspectives on market movements and performance.

Sector Analysis and Sector Rotation

Sector analysis and sector rotation are crucial components of understanding the dynamics and performance of the S&P 500 index. Examining the performance of different sectors within the index can provide insights into sector-specific trends, investor sentiment, and opportunities for portfolio optimization.

Sector Representation:

- The S&P 500 index consists of various sectors that encompass different industries and economic activities.

- Common sectors within the index include technology, healthcare, financials, consumer discretionary, industrials, energy, consumer staples, materials, utilities, and real estate.

- Each sector represents a distinct segment of the economy and has its dynamics, drivers, and factors influencing performance.

Performance and Diversification:

- Analyzing the performance of different sectors within the S&P 500 index helps investors gauge the relative strength and weaknesses of specific industries.

- Sector performance can vary based on economic conditions, industry-specific factors, regulatory changes, technological advancements, and consumer trends.

- Diversifying across sectors within a portfolio can help mitigate risk and take advantage of opportunities arising from sector-specific events or trends.

Sector Rotation Strategy:

- Sector rotation refers to the strategy of shifting investments between sectors based on changing market conditions and relative sector performance.

- Investors may employ sector rotation strategies to capitalize on the cyclical nature of sectors, aiming to invest in sectors that are expected to outperform while avoiding those anticipated to underperform.

- Sector rotation strategies can be driven by economic indicators, market cycles, policy changes, technological disruptions, or other factors influencing sector performance.

Key Drivers and Considerations:

Several factors can drive sector performance and rotation:

- Macroeconomic Factors: Economic indicators, such as GDP growth, inflation rates, interest rates, and consumer spending, can significantly impact different sectors.

- Industry-Specific Factors: Developments within industries, such as regulatory changes, technological innovations, demographic shifts, and competitive dynamics, can influence sector performance.

- Market Sentiment: Investor sentiment and market trends can sway sector rotation, as investors allocate capital based on perceived risks and opportunities.

- Policy and Political Environment: Changes in government policies, regulations, and geopolitical events can have sector-specific impacts.

Risks and Considerations:

- Sector rotation strategies involve inherent risks, including misjudging market trends, timing, and sector-specific risks.

- Successful sector rotation requires accurate analysis, comprehensive research, and careful monitoring of sector dynamics.

- Investors should consider their risk tolerance, investment objectives, and time horizon when implementing sector rotation strategies.

Tools and Investment Vehicles:

- Various tools and investment vehicles facilitate sector analysis and sector rotation, such as sector-specific exchange-traded funds (ETFs), mutual funds, and stock screeners.

- Sector-specific ETFs provide investors with the ability to gain exposure to a particular sector’s performance and implement sector rotation strategies.

Exchange Traded Funds and Index Investing

Exchange-Traded Funds (ETFs) have gained significant popularity among investors, offering a convenient and cost-effective way to gain exposure to the S&P 500 index and other market indices. Index investing, facilitated by ETFs, has become a popular strategy for both individual and institutional investors.

What are ETFs?

- ETFs are investment funds that trade on stock exchanges, similar to individual stocks. They aim to replicate the performance of an underlying index, such as the S&P 500 index.

- ETFs can be passively managed, tracking the index’s performance, or actively managed, employing strategies to outperform the index.

- ETFs offer diversification benefits by providing exposure to a basket of securities within the index, reducing single-stock risk.

Benefits of ETFs for Index Investing:

- Broad Market Exposure: ETFs provide investors with exposure to the entire S&P 500 index or specific market segments, allowing for broad market participation.

- Cost Efficiency: ETFs generally have lower expense ratios compared to actively managed mutual funds, making them a cost-effective investment option.

- Liquidity: ETFs trade on stock exchanges throughout the trading day, offering investors the ability to buy or sell shares at market prices.

- Transparency: ETFs disclose their holdings regularly, providing investors with transparency regarding the securities they hold.

- Flexibility: ETFs can be bought and sold in real-time, allowing investors to react quickly to market conditions or adjust their portfolio allocations.

Passive vs. Active Index Investing:

- Passive index investing involves holding ETFs that aim to replicate the performance of the S&P 500 index without active stock selection or market timing.

- Active index investing involves using ETFs that follow an actively managed approach, aiming to outperform the index through strategies such as stock selection, sector rotation, or risk management.

Investment Considerations:

- Risk Management: Index investing does not guarantee positive returns and is subject to market risk. Investors should assess their risk tolerance and investment objectives before investing.

- Asset Allocation: ETFs provide exposure to specific market segments or sectors. Investors should consider their overall asset allocation strategy and diversification needs.

- Tracking Error: Passive ETFs aim to closely track the performance of the index. However, tracking errors can occur due to factors such as fees, sampling techniques, and rebalancing.

- Tax Efficiency: ETFs can offer tax advantages due to their structure, such as in-kind creations and redemptions, which can minimize capital gains distributions.

S&P 500 ETFs:

- Several ETFs track the performance of the S&P 500 index, providing investors with options to gain exposure to the index. Examples include SPDR S&P 500 ETF (SPY), iShares Core S&P 500 ETF (IVV), and Vanguard S&P 500 ETF (VOO).

- These ETFs aim to replicate the performance of the S&P 500 index and provide investors with a convenient way to participate in the broader U.S. stock market.

Limitations and Criticisms

Concentration Risk:

- The S&P 500 index is weighted by market capitalization, which means that larger companies have a greater impact on its performance.

- This concentration in the index can result in overexposure to certain sectors or mega-cap companies, potentially increasing concentration risk.

- A decline in a few large companies can significantly impact the index’s performance, potentially masking the performance of smaller companies.

Exclusion of Small-Cap Companies:

- The S&P 500 index focuses on large-cap companies and excludes smaller companies from its composition.

- This exclusion can limit the representation of the broader market and may not capture the performance of small-cap stocks, which can have different risk and return characteristics.

Sector Bias:

- The sector composition of the S&P 500 index can influence its performance and returns.

- During periods when a particular sector outperforms, the index may be positively or negatively affected, depending on the sector’s weight.

- Sector biases can limit diversification opportunities, and investors seeking exposure to specific sectors may need to consider additional investments outside of the index.

Market Timing and Rebalancing Challenges:

- Rebalancing the S&P 500 index can be challenging due to the frequency and magnitude of changes required to maintain accurate representation.

- The timing of index rebalancing and changes in constituents can result in trading costs, which may impact the index’s performance compared to real-time market movements.

Limited Global Exposure:

- The S&P 500 index represents the U.S. stock market but does not include companies from other countries.

- This limited global exposure may not fully capture the performance of international markets or the global economy, which can impact investors with a more global investment approach.

Potential Market Inefficiencies:

- Critics argue that the market capitalization weighting methodology used by the S&P 500 index can lead to inefficiencies and overvaluation of certain companies.

- Large-cap companies that experience significant price increases can become disproportionately weighted, potentially leading to an overvalued market or bubble-like conditions.

Exclusion of Dividends:

- The S&P 500 index is a price return index, meaning it does not include the impact of dividends.

- This exclusion can underestimate the total return potential of the index, as dividends are an essential component of total return and can significantly contribute to long-term performance.

Final Takeaway

The S&P 500 index is an important yardstick and an indicator of the performance of the American stock market. Its approach, architecture, and substance make it a trustworthy indication for investors and financial experts. Investors can navigate the constantly shifting stock market environment by keeping an eye on the index’s performance, examining sector trends, and taking mega-cap companies’ ramifications into account.