Introduction

In the vast landscape of financial markets, where stocks rise and fall like waves in an ocean, there exists a fascinating world of small-cap stocks. These are the relatively lesser-known companies, often with market capitalizations that don’t make front-page news. Yet, they pack a punch when it comes to the potential for growth and opportunity.

At the heart of this universe of small-cap stocks stands the Russell 2000 Index, a name that might not ring as loudly as the Dow or the S&P 500 but holds immense importance for investors seeking untapped potential.

What is the Russell 2000 Index?

The Russell 2000 Index is like a curated playlist of small-cap stocks in the world of investing. It’s a financial yardstick that measures the performance of around 2,000 smaller companies listed on U.S. stock exchanges. But why small-cap? Well, small-cap companies are, as the name suggests, smaller in terms of market capitalization.

Market capitalization is like the stock’s weight class; it’s the total value of all its outstanding shares. Small-cap stocks typically fall on the lighter end of the scale, making them smaller, more agile, and often packed with growth potential. They’re like the plucky underdogs of the stock market.

Now, the Russell 2000 Index isn’t just a random assortment of these smaller companies. It’s carefully put together by the FTSE Russell, a global index provider. They have some ground rules for picking stocks. Companies need to be based in the United States, and they have to meet certain size criteria to make it into the club.

The Russell 2000 Index isn’t about giants like Apple or Amazon; it’s about the little guys. It gives investors a snapshot of how these smaller companies are doing as a group. When you see the Russell 2000 go up or down, it’s like checking the pulse of small-cap stocks.

Historical Origin of Russell 2000 Index

The journey began in 1984 when a company named Frank Russell Company, or simply Russell, decided to shine a light on smaller stocks in the United States. Russell, a global index provider, had the idea that investors needed a way to gauge the performance of smaller companies in the stock market. Why? Because these small fries were often overshadowed by the big names.

So, they set out on a mission to create an index that would represent these smaller, often more nimble companies. They named it the Russell 2000 Index. Now, you might wonder, “Why 2000?” Well, it’s because this index originally contained around 2,000 of these small-cap companies.

The Russell 2000 was like a breath of fresh air for investors. It offered a glimpse into the world of small-cap stocks, which had unique characteristics and growth potential. The idea was to give these smaller players a chance to shine and provide investors with a diversified view of how they were performing.

Over the years, the Russell 2000 grew in popularity, becoming a widely followed benchmark for small-cap stocks. It underwent periodic reconstitutions to keep the list of companies up-to-date and relevant.

Composition of Russell 2000 Index

Consider the Russell 2000 Index a diverse collection of small-cap companies, each bringing its own distinct flavor. To understand its composition, let’s break it down into bite-sized pieces:

- Market Capitalization Criteria: To make it into the Russell 2000 Index, a company’s market capitalization, or market cap, needs to be relatively small. While the exact threshold may vary, it’s typically around $3 billion or less. This means these are companies that aren’t among the corporate giants but are still significant players in their own right.

- U.S.-Based Companies: The companies in the Russell 2000 are required to be based in the United States. They’re the homegrown businesses contributing to the nation’s economic landscape.

- Exchange Listings: Being on a U.S. stock exchange is another prerequisite. These are publicly traded companies whose shares are bought and sold by investors on the U.S. stock markets.

- Annual Reconstitution: Imagine a yearly stock market gathering where every small-cap company is evaluated. This is what Russell does. They take a snapshot of the market and say, “Okay, who qualifies as small-cap this year?” It’s a dynamic process that keeps the index fresh and reflective of the current small-cap landscape.

- Sorting and Classifying: After the annual snapshot, Russell goes to work. They meticulously sort and classify companies based on their market capitalization. Some are invited to join the Russell 2000, while others may find themselves in different Russell indexes, depending on their size.

- Ongoing Adjustments: The index isn’t set in stone. Throughout the year, if a small-cap company experiences significant changes in its market cap, say due to a merger or rapid growth, Russell may make adjustments accordingly.

Small-Cap Stocks and Their Importance

Small-cap stocks may be small in terms of market capitalization, but they play a significant role in the financial world. Let’s delve into the world of small-cap stocks and understand why they are important.

Nurturing Innovation:

Birthplace of Innovation: Small-cap companies are often the breeding grounds for innovation. These firms are agile and can quickly adapt to changing market conditions, making them hotbeds for developing groundbreaking technologies and ideas.

Example: Imagine a small biotech startup called “BioGenX.” With limited bureaucracy and a focus on research, it discovers a breakthrough treatment for a rare disease, potentially changing countless lives.

Driving Economic Growth:

Job Creation: Small-cap stocks are vital in job creation. They often hire locally and provide employment opportunities in communities across the country. As they grow, so do their workforce and the local economy.

Example: “SunBurst Solar,” a small renewable energy company, not only advances clean energy but also employs hundreds in its hometown, boosting the local job market.

Diversification for Investors:

Portfolio Diversification: Small-cap stocks add diversification to investment portfolios. By investing in companies of varying sizes, investors can spread risk and potentially enhance returns.

Example: An investor has a portfolio filled with large-cap tech giants but decides to add shares of “TechWidgets Inc.” to diversify and gain exposure to smaller, more promising tech companies.

Driving Competition:

Healthy Competition: Small-cap companies compete with larger counterparts, fostering a competitive market environment. This competition can lead to better products, services, and pricing for consumers.

Example: “GreenTech Innovations” challenges established players in the electric vehicle market, pushing them to innovate and offer more eco-friendly options.

Potential for Growth:

Growth Opportunities: Small-cap stocks have the potential for rapid growth. When they succeed, their stock prices can surge, offering investors substantial returns.

Example: “BioHealth Solutions,” a small pharmaceutical firm, sees its stock price soar after a successful drug approval, benefiting early investors.

Investing in the Future:

Spotting Tomorrow’s Giants: Some of today’s small-cap stocks can become tomorrow’s giants. Investors who identify these promising companies early can benefit from their growth.

Example: “GreenTech Innovations” started as a small-cap player but became a major player in the sustainable transportation industry.

In conclusion, small-cap stocks are more than just modest market players. They are the engines of innovation, drivers of economic growth, and essential components of diversified portfolios. By recognizing their importance, investors can tap into the potential of these small but mighty stocks and contribute to fostering a dynamic and competitive market landscape.

Russell 2000 VS Other Major Indices

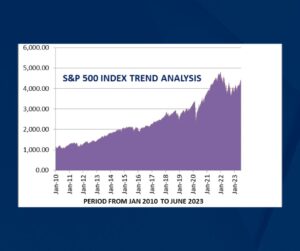

Russell 2000 Index vs. S&P 500 Index:

Size: The most significant difference is in the size of the companies they represent. The S&P 500 index includes the 500 largest U.S. companies, while the Russell 2000 focuses on the 2,000 smallest. This means the S&P 500 includes large-cap stocks, while the Russell 2000 is all about small-cap stocks.

Diverse Sectors: The S&P 500 encompasses a broader range of sectors, including technology, healthcare, finance, and consumer goods. The Russell 2000 is often more concentrated in sectors like healthcare, technology, and industrials.

Risk and Reward: Generally, small-cap stocks, as represented by the Russell 2000, carry more risk but also offer potentially higher rewards. Large-cap stocks in the S&P 500 tend to be more stable but may have slower growth.

Russell 2000 Index vs. Nasdaq Composite Index:

Technology Emphasis: The Nasdaq Composite Index is known for its heavy emphasis on technology companies. While the Russell 2000 does include tech stocks, it’s more diverse in terms of sectors.

Listing Venue: The Nasdaq Composite lists companies based on their exchange venue (Nasdaq), while the Russell 2000 is based on market capitalization. A company listed on the NYSE but with a small market cap could be in the Russell 2000.

Geographical Focus: The Nasdaq Composite extends beyond U.S. borders and includes international companies. The Russell 2000 strictly focuses on U.S. small-cap stocks.

Russell 2000 Index vs. Dow Jones Industrial Average (DJIA):

Company Selection: The Dow Jones Industrial Average (DJIA) comprises 30 large, well-established U.S. companies. In contrast, the Russell 2000 consists of 2,000 small-cap stocks, offering more variety.

Diversification: The DJIA is price-weighted, meaning higher-priced stocks have more influence, while the Russell 2000 is market-cap-weighted, so larger companies have a more significant impact.

Sector Mix: The DJIA has a historical focus on industrial and blue-chip companies. The Russell 2000 covers a broader array of sectors, including smaller industrial and consumer companies.

Russell 2000 vs. MSCI World Index:

Global vs. Domestic: The MSCI World Index represents global stocks from various countries, while the Russell 2000 is solely focused on U.S. small-cap stocks.

Risk and Diversification: Investing in the MSCI World Index offers international diversification, potentially reducing risk. The Russell 2000 is more U.S.-centric and carries higher exposure to domestic market fluctuations.

Market Capitalization: The MSCI World Index includes large-cap, mid-cap, and some small-cap stocks from around the world. The Russell 2000 concentrates exclusively on small-cap U.S. stocks.

Factors Affecting Small-Cap Stocks

Small-cap stocks, as represented by the Russell 2000 Index, offer unique investment opportunities and challenges. Understanding the factors that can influence these stocks is essential for investors looking to venture into this market segment. Here are some key factors affecting small-cap stocks:

Economic Conditions:

Economic Cycles: Small-cap stocks are particularly sensitive to economic cycles. During economic expansions, they can experience rapid growth, while economic downturns may lead to greater volatility and declines.

Interest Rates: Changes in interest rates can impact small-cap stocks. Rising rates may increase borrowing costs for small businesses, potentially affecting their profitability.

Market Sentiment:

Investor Sentiment: Small-cap stocks are often more influenced by investor sentiment than large-cap stocks. Positive sentiment can drive these stocks higher, while negative sentiment can lead to steep declines.

Liquidity: Small-cap stocks tend to have lower trading volumes, making them susceptible to larger price swings due to lower liquidity.

Company-specific Factors:

Financial Health: The financial stability of small-cap companies is crucial. Investors should assess factors like debt levels, cash flow, and profitability.

Management Quality: Competent management is essential for small-cap success. Leadership that can navigate challenges and execute growth strategies is a significant asset.

Innovation and Growth Potential: Investors often look for small-cap companies with innovative products or services and significant growth potential.

Regulatory Environment:

Regulatory Changes: Government regulations can impact small-cap stocks, especially in heavily regulated industries like healthcare and finance.

Tax Policies: Changes in tax policies can influence small-cap businesses, affecting their earnings and valuations.

Competition:

Competition within Sectors: Small-cap companies often face fierce competition within their industries. The ability to differentiate and capture market share is critical.

Global Factors:

Global Economic Events: Events like trade tensions or global economic crises can affect small-cap stocks, as they may have international exposure.

Currency Fluctuations: Small-cap companies involved in international trade can be vulnerable to currency fluctuations.

Access to Capital:

Financing Availability: Small-cap companies rely heavily on access to capital for growth. Tight credit conditions or limited financing options can hinder expansion.

Market Volatility: Small-cap stocks can experience higher price volatility, which can impact their ability to raise capital.

Investor Behavior:

Herd Mentality: Small-cap stocks may be influenced by herd behavior, where investors rush in or out of these stocks based on trends.

Long-term vs. short-term: Investors may have varying investment horizons, impacting the stock’s price over the short and long term.

Small-cap stocks, as represented by the Russell 2000 Index, offer unique investment opportunities and challenges. Understanding the factors that can influence these stocks is essential for investors looking to venture into this market segment. Here are some key factors affecting small-cap stocks:

Investing in Russell 2000 Index

The Russell 2000 Index, comprising 2,000 small-cap stocks, offers investors exposure to a diverse range of companies with the potential for substantial growth. Here’s a comprehensive guide on how to invest in the Russell 2000:

Understand Small-Cap Stocks:

Research: Familiarize yourself with the characteristics of small-cap stocks. They represent smaller companies with market capitalizations typically ranging from $300 million to $2 billion. These companies often have significant growth potential but may come with higher volatility.

Risk Assessment: Assess your risk tolerance. Small-cap stocks can be more volatile than their larger counterparts, so it’s essential to determine how much risk you’re willing to take on.

Choose Your Investment Vehicle:

Exchange-Traded Funds (ETFs): Consider investing in Russell 2000 ETFs. These funds replicate the index’s performance and offer diversification across the 2,000 small-cap stocks.

Mutual Funds: Some mutual funds specialize in small-cap stocks, including those that closely track the Russell 2000 Index.

Direct Stock Investment: Alternatively, you can invest directly in individual stocks from the Russell 2000 Index. However, this approach requires extensive research and may lack diversification.

Diversification:

ETFs and Mutual Funds: If you opt for ETFs or mutual funds, you’ll benefit from built-in diversification across numerous small-cap stocks. This spreads risk and reduces the impact of individual stock fluctuations.

Individual Stocks: If you choose to invest directly in individual stocks, diversify your portfolio by selecting stocks from various sectors and industries. Don’t invest your entire portfolio in a single stock.

Due Diligence:

Research Small-Cap Companies: If you’re considering direct stock investments, conduct thorough research on each company. Assess financial health, management quality, growth prospects, and competitive advantages.

Review Fund Holdings: If investing in ETFs or mutual funds, review the holdings within the fund to ensure they align with your investment goals.

Long-Term Perspective:

Patience: Small-cap stocks may take time to realize their growth potential. Adopt a long-term perspective on market volatility.

Reinvestment: Consider reinvesting dividends or capital gains to take advantage of compounding over time.

Risk Management:

Stop-Loss Orders: If investing in individual stocks, consider implementing stop-loss orders to limit potential losses.

Regular Monitoring: Continuously monitor your investments and stay informed about company developments and market trends.

Cost Considerations:

Be aware of expense ratios when investing in ETFs or mutual funds. Reduced costs can increase your overall returns.

Market Timing:

Attempting to time the market can be challenging and risky. Rather, concentrate on your long-term investment objectives.

Seek Professional Advice:

Consult a financial advisor for personalized guidance, especially if you’re new to investing in small-cap stocks.

Review and Adjust:

Make sure your investments are in line with your financial goals by periodically reviewing them. Adjust your portfolio if necessary.

Stay Informed:

Stay informed about market developments, economic trends, and changes in the Russell 2000 Index composition.

Historical Performance: Russell 2000 Index

- The Russell 2000 Index, representing small-cap stocks, has shown significant long-term growth over several decades.

- During the 1980s, the Russell 2000 experienced substantial growth, reflecting the overall economic expansion and increased interest in small-cap stocks. For instance, from 1980 to 1989, the index surged from around 100 points to over 350 points.

- Like other indices, the Russell 2000 also felt the impact of the dot-com bubble burst in the early 2000s. Many technology-related small-cap stocks faced steep declines.

- After the global financial crisis of 2008, the Russell 2000, along with other indices, faced a significant drop. However, it made a remarkable recovery in the following years as the economy improved. For instance, from its low point in early 2009, it nearly tripled in value by 2013.

- In the 2020s, the index continued to display resilience and growth, although it experienced fluctuations due to factors like the COVID-19 pandemic and economic uncertainty.

- After a sharp decline in early 2020 due to pandemic-related concerns, the Russell 2000 rebounded, reflecting optimism about the economic recovery and fiscal stimulus measures. It reached record highs in 2021.

- Small-cap stocks, represented in the Russell 2000, are known for their higher volatility compared to large-cap stocks. This can result in periods of rapid gains and losses.

- The index’s performance is influenced by various sectors, with some industries outperforming in specific market conditions. For example, technology and healthcare companies have played significant roles in its performance.

- During the late 1990s and early 2000s, the technology sector, including small-cap tech companies, saw tremendous growth, contributing to the index’s overall performance.

- Investors often compare the Russell 2000’s performance to other indices like the S&P 500 to assess the relative performance of small-cap stocks against large-cap stocks.

- In certain periods, the Russell 2000 has outperformed the S&P 500, making it attractive to investors seeking higher growth potential. In contrast, during economic downturns, it may underperform larger indices.

- Sentiment plays a role in the index’s performance. Positive sentiment can drive small-cap stocks higher, while negative sentiment can lead to declines.

- Events like changes in the economic outlook, political developments, or market sentiment shifts can trigger rapid fluctuations in the index. The impact of such events may vary.

- Investing in the Russell 2000 can provide diversification benefits, reducing risks associated with individual stock movements, as the index includes a broad range of small-cap companies.

- During market downturns, certain small-cap stocks may perform well, offsetting losses in other parts of a portfolio.

- Investors should consider the historical volatility and risk associated with the Russell 2000 and implement risk management strategies as needed to safeguard their investments.

It’s essential to note that past performance is not indicative of future results, and investing in small-cap stocks carries inherent risks. Conduct thorough research, diversify your portfolio, and consider your investment goals and risk tolerance when including the Russell 2000 Index or similar assets in your investment strategy.

Risks and Challenges Associated with Small-Cap Companies

Investing in small-cap stocks through the Russell 2000 Index can be rewarding, but it also comes with its fair share of risks and challenges that investors should be aware of.

Higher Volatility:

Small-cap stocks are more volatile than larger-cap stocks. They can experience significant price fluctuations over short periods. This volatility can result in both substantial gains and losses for investors.

Limited Resources:

Many small-cap companies have limited financial and operational resources compared to larger corporations. This means they may struggle to weather economic downturns, access capital, or compete effectively in their industries.

Lack of Liquidity:

Some small-cap stocks may have lower trading volumes, making it challenging to buy or sell shares without impacting the stock’s price. This illiquidity can lead to wider bid-ask spreads and potentially higher trading costs.

Market Sentiment Sensitivity:

Small-cap stocks can be highly sensitive to shifts in market sentiment and economic conditions. They may underperform during economic downturns and outperform during economic upswings.

Higher Risk of Business Failure:

Smaller companies face a higher risk of business failure compared to larger, more established corporations. Investors in small-cap stocks must be prepared for the possibility of some companies in the Russell 2000 going out of business.

Limited Analyst Coverage:

Small-cap stocks often receive less attention from analysts and financial media, making it harder for investors to access comprehensive research and analysis. This means investors may need to conduct more of their own research.

Sector Concentration:

The Russell 2000 Index can have significant sector concentration at times. For example, during certain periods, a single sector like technology or healthcare may dominate the index. Investors may be exposed to sector-specific risks due to this concentration.

Lack of Dividends:

Many small-cap companies reinvest their earnings back into the business rather than paying dividends. This can limit the income potential for investors who rely on dividend income.

Macroeconomic Factors:

Factors such as interest rate changes, inflation, and currency fluctuations can have a pronounced impact on small-cap stocks. Investors should be mindful of broader economic trends and their potential effects on the Russell 2000.

Limited Resources for Research:

Researching individual small-cap stocks can be time-consuming and challenging due to limited available data and resources. Investors may need to rely on alternative sources of information.

Diversification:

Achieving adequate diversification in a portfolio of small-cap stocks can be challenging due to the sheer number of holdings required. Investors often turn to small-cap exchange-traded funds (ETFs) or mutual funds for diversification.

Long-Term Perspective:

Investing in small-cap stocks through the Russell 2000 often requires a long-term perspective. While these stocks can offer significant growth potential, it may take years for this potential to materialize.