Building Wealth through Value Investing: Time Tested Techniques

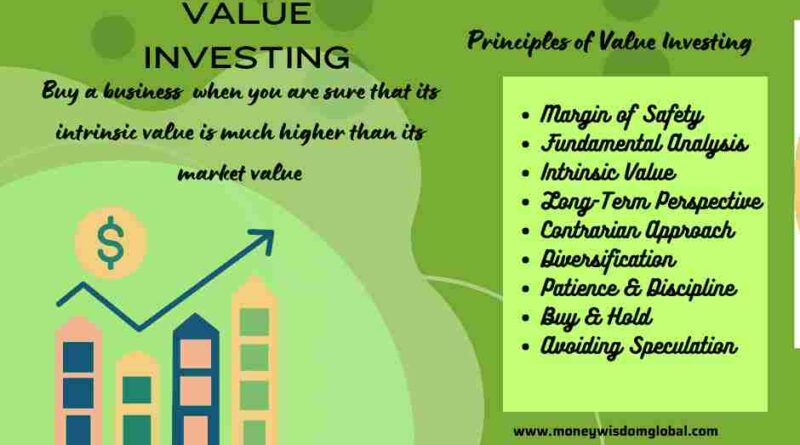

What is value investing?

Value investing is an investment approach that revolves around the selection of stocks perceived to be trading below their intrinsic or book value. Practitioners of value investing actively seek out stocks they believe are undervalued by the stock market. They hold the conviction that the market often reacts excessively to both positive and negative news, causing stock prices to fluctuate without necessarily aligning with a company’s long-term fundamentals. This market volatility presents an opportunity for value investors to acquire stocks at discounted rates.

The roots of value investing trace back to 1934, when it was conceived by Columbia Business School professors Benjamin Graham and David Dodd. Its widespread recognition came with Graham’s publication of “The Intelligent Investor” in 1949. In contemporary times, Warren Buffett, a student of Benjamin Graham, stands as one of the most renowned practitioners of value investing.

At its core, the fundamental idea driving value investing is simple: possessing knowledge of an asset’s true value can lead to substantial cost savings when making a purchase. In common terms, whether you acquire a new television on sale or at its regular price, you receive the same television with identical screen size and picture quality.

Similarly, the dynamics of stock prices follow a parallel pattern, implying that a company’s share price can fluctuate even when the company’s intrinsic value remains constant. While there may not exist an absolute or intrinsic value for a specific company’s stock, there are relative values.

Market participants engage in buying and selling shares without being bound by a fixed objective price. Consequently, stocks, like televisions, undergo periods of heightened and diminished demand, resulting in price variations. When a company’s fundamental characteristics and prospects remain unaltered, the value of its shares essentially remains the same, despite differences in market prices.

Key Principles of Value Investing

Margin of Safety:

Value investors prioritize the concept of a “margin of safety.” This means they aim to buy assets, such as stocks, at a price significantly lower than their intrinsic value. This provides a cushion against potential losses and reduces investment risk.

Fundamental Analysis:

Value investors focus on analyzing a company’s fundamentals, including its financial statements, earnings, cash flow, and balance sheet. They seek companies with strong financial health and stable earnings.

Intrinsic Value:

Value investors estimate the intrinsic value of a stock, which is their assessment of its true worth based on a company’s financials and future earnings potential. They buy stocks when they believe the market price is lower than the intrinsic value.

Long-Term Perspective:

Value investing is a long-term strategy. Investors are willing to hold onto their investments for years, sometimes even decades, to realize their full potential.

Contrarian Approach:

Contrarian thinking is common among value investors.. They are willing to buy stocks that are out of favor with the market, believing that market sentiment may not accurately reflect a company’s true value.

Diversification:

While focusing on undervalued stocks, value investors also recognize the importance of diversification. They spread their investments across different industries and asset classes to reduce risk.

Avoiding Speculation:

Value investors avoid speculative investments and high-risk assets. They prioritize investments with a clear and predictable path to value appreciation.

Patience and Discipline:

Value investing requires patience. Investors are prepared to wait for the market to recognize the true value of their investments. They also maintain discipline by sticking to their investment criteria and not being swayed by short-term market fluctuations.

Buy and Hold:

Value investors believe in the “buy and hold” strategy. They hold onto their investments through market ups and downs, only selling when the investment reaches or exceeds its intrinsic value.

Continuous Learning:

Value investors continuously educate themselves about financial markets, economic trends, and investment strategies. They adapt to changing market conditions while staying true to their value-based principles.

These principles guide value investors in their quest to identify undervalued assets and build wealth over the long term. They serve as a foundation for making informed investment decisions and consciously managing risk.

Value Investing VS Growth Investing

Objective:

Value Investing: To identify undervalued assets (e.g., stocks) and buy them at a price lower than their intrinsic value, with the goal of long-term capital appreciation.

Growth Investing: To invest in companies with strong potential for above-average earnings growth, even if their current valuations may be relatively high.

Stock Selection:

Value investing focuses on stocks that are trading below their intrinsic value, often in mature or out-of-favor industries.

Growth investing prioritizes stocks of companies expected to experience rapid revenue and earnings growth, often in emerging or high-tech sectors.

Risk Tolerance:

Value investing generally considered a lower-risk strategy due to the emphasis on buying undervalued assets.

Growth investing carry higher risk because of the expectation of future growth, which is not always realized.

Value Investing vs. Dividend Investing:

Objective:

Value Investing: aims for capital appreciation by buying undervalued assets, with dividends being a secondary consideration.

Dividend Investing: Focuses on building a portfolio of stocks that provide a consistent stream of dividend income, with capital appreciation as a secondary goal.

Stock Selection:

Value Investing: Looks for stocks with potential for long-term growth, regardless of their dividend yield.

Dividend Investing: prioritizes stocks of companies with a history of paying dividends and a commitment to regular dividend increases.

Income or Capital Appreciation:

Value Investing: primarily seeks capital appreciation, but dividends can provide an additional income stream.

Dividend Investing: prioritizes dividend income as a primary source of returns.

Value Investing vs. Technical Analysis:

Objective:

Value Investing: focuses on the intrinsic value of assets and their long-term potential for growth.

Technical Analysis: Aims to predict future price movements based on historical price data and chart patterns, with a shorter-term focus.

Analysis Approach:

Value Investing: relies on a fundamental analysis of a company’s financials and industry conditions.

Technical Analysis: Analyzes price charts, volume, and technical indicators to make trading decisions.

Investment Horizon:

Value Investing: is typically a long-term strategy.

Technical Analysis: This can involve intraday or swing trading as well as long-term investing.

Value Investing vs. Index Investing:

Objective:

Value Investing: seeks to outperform the broader market by selecting undervalued assets.

Index Investing: aims to match the performance of a specific market index (e.g., S&P 500) by investing in all or a representative sample of its components.

Stock Selection:

Value Investing: involves active stock selection based on analysis and research.

Index Investing: passively tracks the components of a market index without individual stock selection.

Management Fees:

Value Investing: This may incur higher costs due to active management and research.

Index Investing: generally has lower management fees due to its passive nature.

Each of these investment strategies has its merits and may be suitable for different investors based on their financial goals, risk tolerance, and investment horizon. Some investors may even combine elements of these strategies to create a diversified portfolio that aligns with their objectives.

How to Identify Value Stocks?

Identifying value stocks involves a thorough analysis of individual companies and their financials to determine if their current market price is lower than their intrinsic value. Here are the key steps and criteria for identifying value stocks:

1. Financial Statement Analysis:

Earnings and Revenue: Look for companies with consistent and preferably growing earnings and revenue over the past several years.

Profit Margin: Check for healthy profit margins compared to industry peers. A company with higher margins may indicate better profitability.

Debt Levels: Assess the company’s debt-to-equity ratio. Lower levels of debt relative to equity are generally preferable, as they indicate lower financial risk.

2. Price-to-Earnings (P/E) Ratio:

Compare the company’s current P/E ratio to historical averages and industry benchmarks. A lower P/E ratio suggests the stock may be undervalued.

3. Price-to-Book (P/B) Ratio:

Examine the P/B ratio to assess whether the stock’s market price is significantly lower than its book value (assets minus liabilities). A P/B ratio less than 1 may indicate potential undervaluation.

4. Dividend Yield:

Consider the dividend yield, especially if you are looking for income. A higher dividend yield relative to the stock’s historical average or industry peers could be a sign of value.

5. Free Cash Flow:

Analyze the company’s free cash flow, which represents the cash generated after expenses and capital expenditures. Positive and growing free cash flow can be a positive indicator.

6. Competitive Position and Moat:

Evaluate the company’s competitive advantages or economic moat. Companies with strong moats are more likely to maintain profitability over the long term.

7. Management Quality:

Research the management team’s track record and integrity. Look for management that allocates capital wisely and prioritizes shareholder interests.

8. Industry and Market Conditions:

Consider the company’s industry and market conditions. Some industries may be cyclical, and value stocks in those industries may perform better at certain points in the economic cycle.

9. Historical Performance:

Review the stock’s historical performance. Has it had periods of undervaluation in the past, followed by significant price increases?

10. Analyst Opinions:

Take into account analyst opinions and consensus estimates. Sometimes, stocks may be undervalued due to temporary factors that analysts have not yet recognized.

11. Diversification:

Maintain a diversified portfolio of value stocks across different industries and sectors to spread risk.

12. Avoiding Value Traps:

Be cautious of stocks with low valuations but poor fundamentals. These are often referred to as “value traps” and can result in substantial losses.

13. Patience:

Value investing requires patience. After identifying a value stock, be prepared to hold it for the long term until the market recognizes its true value.

Remember that value investing involves careful research and analysis. It’s essential to have a well-defined investment strategy and to continually monitor your investments to ensure they align with your financial goals and risk tolerance. Additionally, consider consulting with a financial advisor or investment professional for guidance and expertise in value stock selection.

Famous Value Investors

Several famous value investors have achieved significant success by following the principles of value investing. Here are some well-known value investors and their contributions to the investment world:

Benjamin Graham:

Often regarded as the “Father of Value Investing,” Benjamin Graham‘s book “The Intelligent Investor” (1949) is considered a cornerstone of value investing philosophy. He advocated for the concept of a “margin of safety” and developed fundamental analysis techniques. Graham also mentored Warren Buffett.

Warren Buffett:

Warren Buffett is one of the most renowned value investors in history. He is the chairman and CEO of Berkshire Hathaway and is often referred to as the “Oracle of Omaha.” Buffett’s disciplined approach to value investing has led to extraordinary long-term returns for Berkshire Hathaway shareholders.

Charlie Munger:

Charlie Munger is the vice chairman of Berkshire Hathaway and a close collaborator of Warren Buffett. Munger is known for his sharp wit and for contributing to the development of Berkshire Hathaway’s investment philosophy. He emphasizes the importance of rational thinking and simplicity in investing.

Seth Klarman:

Seth Klarman is the founder of Baupost Group, a highly successful hedge fund known for its value-oriented approach. Klarman’s book, “Margin of Safety,” is considered a must-read for value investors. He stresses the significance of patience and risk management.

Joel Greenblatt:

Joel Greenblatt is an investor and author known for his book “The Little Book That Beats the Market.” He developed the “Magic Formula,” a quantitative approach to value investing that combines earnings yield and return on capital.

Howard Marks:

Howard Marks is the co-founder and co-chairman of Oaktree Capital Management. While not strictly a value investor, Marks is known for his insightful investment memos, where he discusses market cycles, risk assessment, and value investing principles.

Walter Schloss:

Walter Schloss was a successful value investor who worked with Benjamin Graham and later ran his own investment partnership. He followed a simple yet effective approach of buying undervalued stocks and holding them for the long term.

Irving Kahn:

Irving Kahn was one of the oldest active investors until his passing in 2015 at the age of 109. He was a student of Benjamin Graham and employed value investing principles throughout his career.

Bill Ackman:

Bill Ackman is the founder of Pershing Square Capital Management and is known for his activist investing approach. While not a traditional value investor, he has made value-oriented investments in companies such as Berkshire Hathaway and Chipotle.

Mohnish Pabrai:

Investor and managing partner of Pabrai Investment Funds, Mohnish Pabrai is an Indian-American. He is known for his deep value investing approach, inspired by Warren Buffett and Charlie Munger.

These famous value investors have demonstrated that value investing principles, when applied with discipline and patience, can lead to long-term investment success. While their individual strategies and approaches may vary, they all share a commitment to finding undervalued assets and achieving strong returns over time.

Common Mistakes to Avoid

Value investing, while a proven investment strategy, is not without its challenges and potential pitfalls. Here are some common mistakes to avoid when practicing value investing:

Neglecting Proper Research:

Mistake: Failing to thoroughly research and analyze a company’s financials, competitive position, and industry dynamics.

Avoidance: Conduct in-depth due diligence, including reading annual reports, studying financial statements, and staying informed about industry trends.

Ignoring Quality for Cheapness:

Mistake: Prioritizing low stock prices over the quality of the company. Investing in companies with poor fundamentals can lead to value traps.

Avoidance: Seek companies with solid financials, competitive advantages, and a history of profitability.

Short-Term Focus:

Mistake: Expecting quick returns and selling undervalued stocks prematurely.

Avoidance: Adopt a long-term perspective, as value stocks may take time to reach their intrinsic value.

Overlooking Management Quality:

Mistake: Failing to assess the competence and integrity of a company’s management team.

Avoidance: Research the management’s track record and commitment to shareholder interests.

Neglecting Diversification:

Mistake: Concentrating investments in a few value stocks or a single sector, increases portfolio risk.

Avoidance: Maintain a diversified portfolio across different industries to spread risk.

Chasing Falling Knives:

Mistake: Buying stocks solely because their prices are declining, assuming they will eventually rebound.

Avoidance: Ensure there are fundamental reasons to believe the stock is undervalued, rather than blindly catching falling stocks.

Failing to Reevaluate Investments:

Mistake: Not regularly reviewing and updating the investment thesis for each holding.

Avoidance: Continually monitor the financial health and performance of the companies in your portfolio.

Emotional Investing:

Mistake: Letting fear or greed drive investment decisions rather than sticking to a well-defined strategy.

Avoidance: Establish clear investment criteria and follow a disciplined approach, ignoring short-term market fluctuations.

Underestimating Macro Factors:

Mistake: Ignoring broader economic and market conditions that can impact the performance of value stocks.

Avoidance: Consider macroeconomic factors, interest rates, and market trends in your investment decisions.

Overlooking Competitive Dynamics:

Mistake: Failing to assess a company’s competitive position and its ability to maintain profitability.

Avoidance: Analyze a company’s competitive advantages or economic moat to gauge its long-term prospects.

Lack of Patience:

Mistake: Selling value stocks too soon due to impatience or the temptation of quick gains.

Avoidance: Stay committed to your long-term investment strategy and allow time for the market to recognize value.

Not Adapting to Changing Circumstances:

Mistake: Sticking rigidly to a value investing strategy without adjusting to changing market conditions.

Avoidance: Be flexible and willing to adapt your strategy as market dynamics evolve.

References:

Books:

- “The Intelligent Investor” by Benjamin Graham: This classic book is considered the bible of value investing. It provides timeless principles and strategies for investors.

- “Security Analysis” by Benjamin Graham and David Dodd: Another seminal work by Benjamin Graham, this book offers a comprehensive guide to analyzing stocks and bonds.

- “Margin of Safety” by Seth A. Klarman: Although it’s out of print and can be quite expensive, this book is highly regarded among value investors for its insights into risk management.

- “The Little Book of Value Investing” by Christopher H. Browne: This book offers a straightforward and accessible introduction to value investing concepts.

Courses and Online Learning:

- Columbia Business School’s Value Investing Program: Columbia offers an online program on value investing, which includes lectures and case studies taught by leading experts in the field.

- Coursera’s Value Investing Specialization: This online course series covers various aspects of value investing, including financial statement analysis and valuation techniques.

Udemy’s Value Investing Courses: Udemy offers a range of value investing courses, from beginner to advanced levels, covering topics like stock analysis and portfolio management.